Journal-order form – the most common form of accounting in organizations with various forms of ownership, where accounting is carried out manually. Schematically, this form can be depicted as follows (Figure 15).

Source documents

Registers of analytical accounting for some accounts

Order journals

Cash book

Turnover statements for analytical accounts

main book

Synthetic accounting statements

Recording operations

Record reconciliation

Figure 15 - Scheme of the journal-order form of accounting

With this form of accounting, accounting for cash transactions is carried out in the same way as with a simple form.

The journal-order form of accounting is based on the principle of accumulating data from primary documents in a section that provides synthetic and analytical accounting of funds, sources, business transactions. Here chronological and systematic records are made simultaneously. The journal-order form combines synthetic and analytical accounting in time. Analytical accounting registers may not be entered into all accounts. For example, for account 10 “Materials”, inventory cards are created for each analytical account, and for account 71 “Settlements with accountable persons”, analytical accounting is kept together with synthetic accounting in order journal No. 7. With the journal-order form of accounting, entries can be made from primary documents directly to synthetic accounting registers. These registers include: order journals and statements.

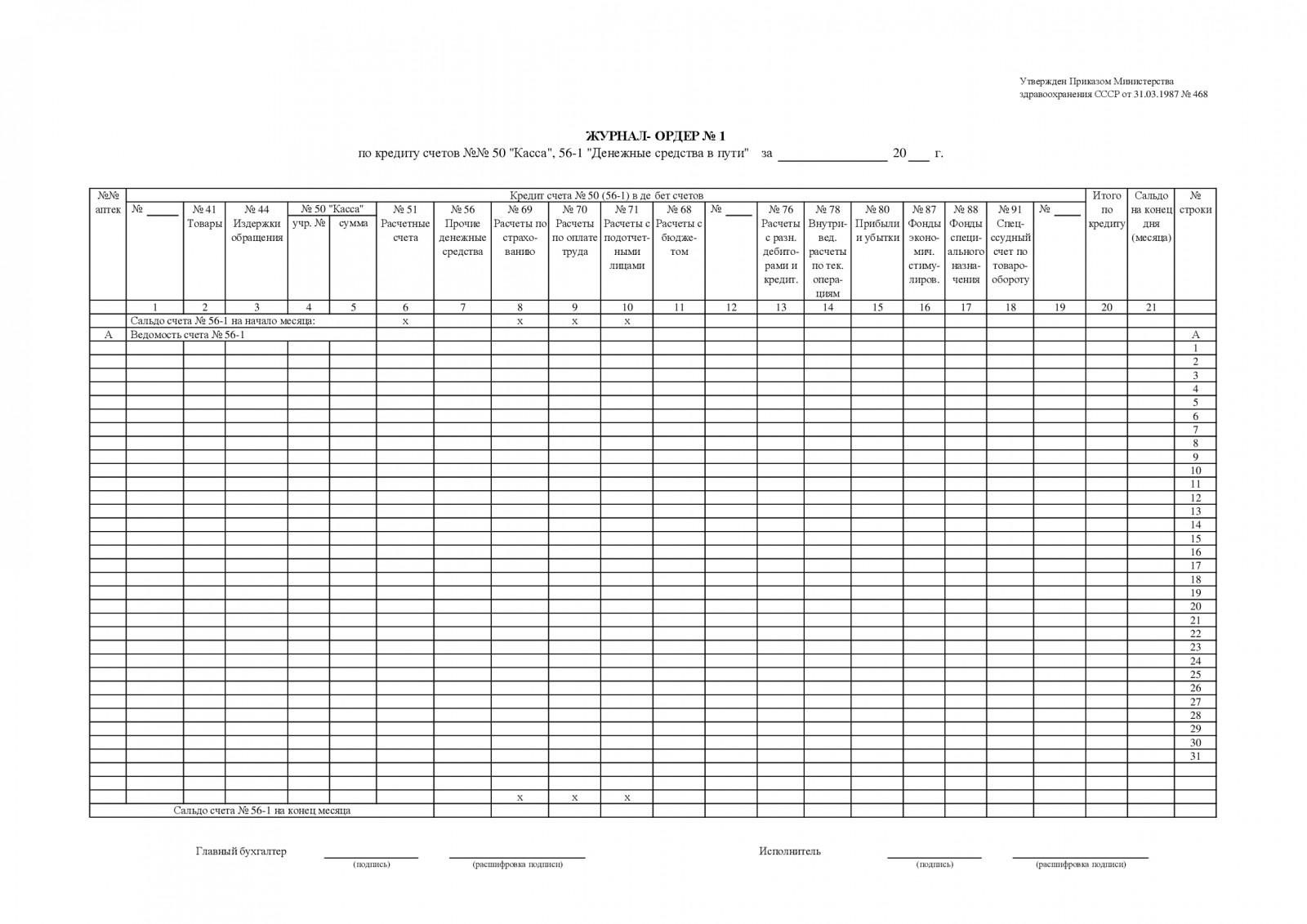

Order journals are accounting registers, built according to the chess principle, they are opened on a separate account, where the credit turnover on the account is recorded. Records are kept as documents are received. The order journals reflect the credit turnover for an account or for each primary document, or for a group of documents per day. For example, in the journal-order No. 1 on the credit of account 50 "Cashier" (Figure 16), entries are made for each day based on the cashier's reports (Figure 2).

Magazine-order No. 1

for __________ 20__

|

From the credit of account 50 "Cashier" to the debit of accounts | |||||||||

Accountant _______________

Figure 16 - Journal-order No. 1 on the credit of account 50 "Cashier"

In this journal-warrant, the date of the cashier's report is indicated, and then the amounts are posted to the corresponding accounts. Debit of some account credit of account No. 50. If the debit of the same account is repeated in the cashier's report, then the amounts are added up. Those. The order journal reflects the credit turnover of the account. To reflect debit turnovers, statements are compiled

Sheets are accounting registers built according to the chess principle, they are opened on a separate account, where debit turnovers on the account are recorded. For example, for account 50 "Cashier" a statement No. 1 is compiled for the debit of account 50 "Cashier" (Figure 17).

Organization____________________

The activity of any enterprise cannot be imagined without financial transactions. The accountant should keep records of such transactions in a special journal-order.

A journal-order is an accounting table, which is built in a chess form: credit accounts are placed vertically, and debit accounts are placed horizontally.

This allows a single entry to post both a debit account and a credit account.

Dear readers! The article talks about typical ways to solve legal issues, but each case is individual. If you want to know how solve exactly your problem- contact a consultant:

(Moscow)

(Saint Petersburg)

(Regions)

It's fast and is free!

The principle of the journal system

In this journal, the registration of credit turnover by everyone balance accounts. It also records every transaction that concerns a credit or other account.

Based on the data from this log, product cost calculation and enterprises, as well as the costs of the production process.

Based on the data from this log, product cost calculation and enterprises, as well as the costs of the production process.

The journal-order consists of a register on the right side and a statement of the debit account, where each debit turnover is deciphered.

This log records:

- opening balance;

- debit account amounts;

- correspondent accounts.

At the end of each month, the accountant calculates the final data, which he enters into general ledger.

Any journal-order is filled according to chess principle- the sum of the rows must necessarily coincide with the sum of the columns. Each line corresponds to a specific date.

Every month the enterprise starts a new journal-order for every account. Each journal is assigned a permanent number.

The final data at the end of each month allows you to get total amount credit and debit turnover.

The data obtained from journaling is used to populate the General Ledger.

The turnover on the credit account is recorded from the corresponding journal-order, but the turnover on the debit account must be recorded from different journals on the correspondent's accounts.

Due to the fact that the order journal is filled in according to the credit principle, and the General Ledger is filled in according to the debit principle, possibility of duplication revolutions excluded.

It is necessary to fill in the General Ledger for all accounts every month during the year. There is 1 page for each account in this book. For each account, the credit and debit turnovers for the entire month are recorded, as well as the balance indicator at the beginning and at the end of the month.

Standard forms of magazines

The government of the USSR approved 10 standard forms order magazines.

The government of the USSR approved 10 standard forms order magazines.

Magazine-order No. 1 registers all cash transactions. For this, a separate column "Cashier" is allocated. The basis for filling out such a journal is the cashier's reports.

One log line reflects information about one report, regardless of the period for which it was compiled.

This means that the number of lines in the log corresponds to the number of reports that were handed over by the cashier.

To register all financial transactions for bank payments on account No. -51, it is used. This form of journal is most often used by industrial organizations. Construction organizations use for this purpose a journal-order in the form No. 2-s, and sales and supply organizations - in the form No. 2-sn.

To register all financial transactions for bank payments on account No. -51, it is used. This form of journal is most often used by industrial organizations. Construction organizations use for this purpose a journal-order in the form No. 2-s, and sales and supply organizations - in the form No. 2-sn.

Magazine-order №3(fig. on the left) registers transactions on several accounts:

Magazine-order №3(fig. on the left) registers transactions on several accounts:

- No. 54 - capital expenditure account;

- No. 55 - bank account;

- No. 56 - an account on the receipt and expenditure of other funds.

All data in order journal No. 3 must be confirmed by bank statements.

If the management of the enterprise draws up a loan or a loan, then cash control on a loan or loan is used journal-order No. 4(fig. right).

This journal records transactions on account No. 90 for short-term loans and on account No. 92 for long-term loans.

Magazine-order No. 5 is designed to record data on transactions that are carried out between counterparties in the course of business activities.

Thanks to this journal, you can avoid debit/credit account arrears.

Magazine-order in the form No. 6 allows you to register the movement of wear and low-value items. Such items may include:

All of the above items are also subject to material and warehouse accounting.

To register data on transactions on advance amounts for employees of the enterprise, journal-order №7.

To register data on transactions on advance amounts for employees of the enterprise, journal-order №7.

It records all transactions with accountable funds.

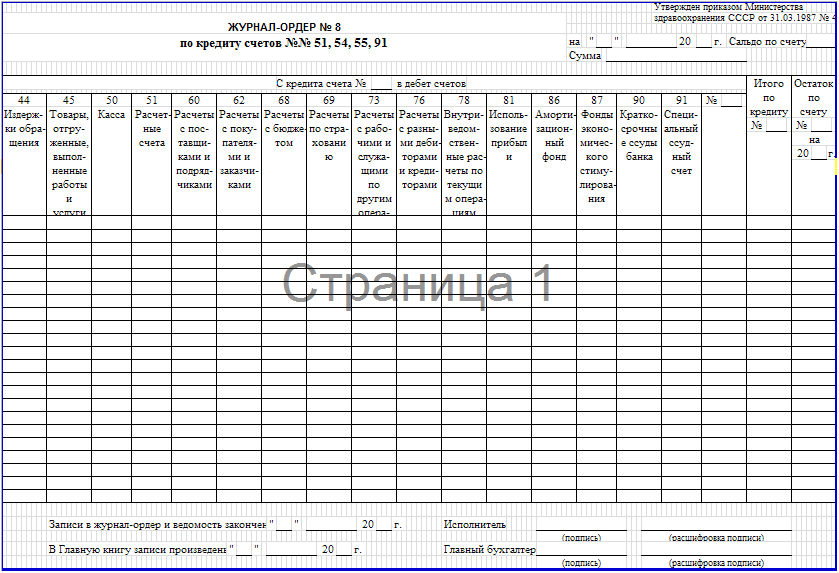

Log-order according to the form No. 8 is drawn up to account for transactions with advance cash, money that comes as payments from counterparties, expenses with debtors and creditors.

Log-order according to the form No. 8 is drawn up to account for transactions with advance cash, money that comes as payments from counterparties, expenses with debtors and creditors.

Also counting share income organizations.

Any on-farm settlements of the enterprise are displayed in journal-order No. 9. This journal is divided into several sections:

- The magazine itself;

- "Analytical Data";

- "General Instructions".

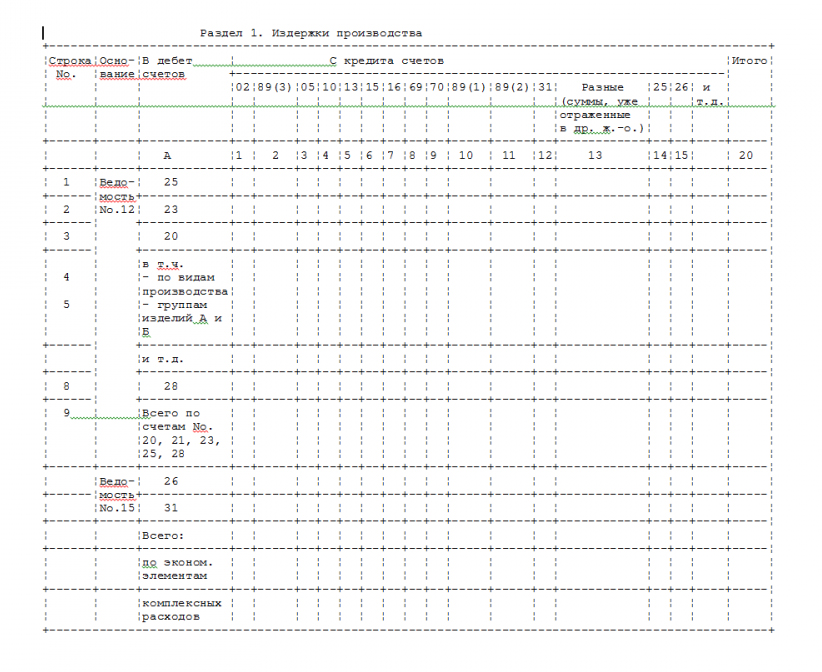

V journal-order No. 10 the following accounts are accounted for:

V journal-order No. 10 the following accounts are accounted for:

- No. 05, No. 06, No. 08, No. 12 - data on material values;

- No. 13 - accounting for worn low-value items and inventory;

- No. 69 - the expenditure of funds for social insurance;

- No. 70 - salaries for employees;

- No. 88 - reserve fund of payments;

- No. 86 - depreciation funds;

- No. 20, No. 23, No. 24, No. 25, No. 26, No. 29, No. 31 - production costs;

- No. 82 - production losses;

- No. 21 - accounting for semi-finished products that are manufactured in production;

- No. 15 - general production costs;

- No. 12 - the consumption of materials in the main and additional production shops.

Magazine-order No. 10 provides summarized data in the context of the structure for each type.

Rules and procedure for filling

Magazine-order No. 1 consists of a statement and the journal itself. In statement No. 1, you must indicate the balance indicator. Next, the accountant records data from the cash book, indicating receipts to the loan account and payments from this account. Based on these data, the debit balance is calculated at the end of the month.

Journal-order No. 2 has a section "Settlement account", where the details of the accounts are entered, according to which the receipt of funds and their payment will be recorded. The basis for making an entry in this journal is statement from the bank.

In the statement and journal-warrant No. 2, do not forget to indicate the start date of the operation and the date of completion of the operation. At the end of the month, the accountant must calculate the balance on the bank account of the enterprise and indicate this amount in the order journal No. 2.

The journal-order in form No. 3 consists of a table where data on receipts from bank statements and other primary documents are entered. The final results are recorded in the same journal. There is no need to count them. You can simply rewrite them from the accumulative sheet.

Registration of indicators in the order journal No. 3 is carried out according to credit sign. This means that the credit account turnover is recorded in correspondence with each debit account.

In order journal No. 4, transactions with credit funds are recorded. To make an entry in such a journal, the accountant must have a basis - an extract from a bank or other credit institution.

All data in the journal-warrant in form No. 4 are indicated in the context of corresponding accounts. On the final page of this journal, data on bank statements or credit organizations are filled in.

To maintain the journal-order No. 5, a unified form is used. This form should contain data from each department or division of the enterprise, where a separate record of financial transactions is kept.

In the column for account No. 64, data on the mutual claims of all participants in financial relations are recorded. To record data on a debit account, a statement is used in which data is entered only on the basis of bank statements on personal accounts of a person who is a participant in mutual settlement.

Log-order No. 6 is the main source of information on the turnover of the company's material assets, so it must be filled out regularly. All data in it must be correct. The data from this journal is transferred to the General Ledger.

All order journals according to this form are filed in the appropriate folder and stored separately from all primary documents.

Journal-order No. 7 keeps records of analytical and synthetic information. Analytical information includes advance funds, the cost of tax deductions, the spent and unspent part of the advance amount, as well as the amount of additional advance payments.

Synthetic information includes travel expenses, as well as advance finance transactions in correspondence with debit accounts. The form of the journal allows you to enter information about 30 operations. If there were more such transactions, the accountant can use slip sheets.

To fill in the journal-warrant in form No. 8, indicators from the primary documentation are used. The registration of the journal is carried out in accordance with all instructions. It must contain the signatures of the accountant and the director, as well as seal impressions.

Filling out the journal-order in the form No. 9 is carried out on the basis of the data of the relevant primary documents, namely from the statement 1 No. 1 and No. 2.

In the "Analytical Data" section, calculations are recorded within various types of farms, as well as the balance indicator for a certain reporting period. If the amount goes in correspondence with the debit of accounts №50, №51 , then it is recorded based on the results for the month.

Only the final data from the statements under No. 12, which are registered in the corresponding account, are transferred to.

If the accounting department keeps records for several shops, then such data must be transferred for each shop separately.

The journal also provides a table where you need to indicate the final and intermediate calculations of the cost of manufactured goods.

In addition, the employee must fill in the following tables in the order journal No. 10

- "Calculation of production costs by economic element"

- "Calculating the cost of commercial products".

It is necessary to fill in the above tables using the data from the first table "Production Costs". In addition, during filling, the accountant uses data from statements and other primary documentation.

In the statement №14 journal-warrant No. 10 reflects amounts regarding defective goods, surpluses or shortages. The accountant generates such data using primary documentation and inventory results.

The cost of surplus items, as well as inventory, is reflected in an amount similar to that indicated in the invoices #12 and #15. The final indicator of the amount of goods or items of one's own is determined using the calculation method.

All data in each journal-order must be entered correctly. Do not forget to indicate the names of the transactions, the dates of their completion. Forms of these journals must be signed officials.

In addition, the forms must contain seal impressions enterprises. If at least one requirement is violated when filling out the form, regulatory or supervisory authorities have the right apply sanctions to such an enterprise.

We offer you to watch an interesting video on how to fill out order journals and the general ledger.

1. Journals - warrants (w / o) are kept for trade (canteen trust) in general or for trade enterprises and Catering. They are opened separately for each of the accounts indicated in the upper right corner (with the exception of railway

N 10 - it can be carried out on several accounts).2. Entries in journals - orders are made on the basis of data from verified and properly executed primary documents or reports of financially responsible persons, bank statements, etc. On the documents recorded in journals - warrants, the following is indicated: the date of recording, N of the journal - warrants, N lines in the journal on which the entry was made.

3. Magazines - orders are built on a credit basis, i.e. registration of credit turnovers for each balance sheet account is carried out in correspondence with debited accounts. The journals - orders reflect all operations related to the credit of an account in correspondence with the debit of the corresponding accounts.

4. Calculation of subtotals is recommended to be done within a month for ten days or five days. At the end of the records for the reporting month, the totals for the month are calculated. For those accounts for which a statement is maintained simultaneously with the journal - order, the results of this statement for each column are compared with the corresponding results of other journals - orders for related accounts. At the time of the inventory of inventory and cash in magazines - orders and statements, the results are necessarily summed up.

5. After calculating and checking the monthly totals, the journals - warrants and statements to them are signed by the person who compiled them, indicating the date. In addition, all journals - warrants are signed by the chief accountant of the trade, trust, office (centralized accounting) or his deputy.

6. Monthly totals of journals - orders are recorded in

Home a book on separate accounts, about which a note is made in the journal - warrant signed by the person who made the entry in Main book. Home In the book, current turnovers are given only for accounts of the first order. Credit turnovers (sum of totals) are transferred as one entry from the corresponding journal - order; debit turnovers - in separate amounts from different journals in correspondence with credited accounts.For those accounts for which a statement is maintained simultaneously with the journal - order, the results of this statement for each column are checked against

Home book. Checking the correctness of the entries made in Home book, is carried out by calculating the amounts of turnover and balances for all accounts.7. Correction of errors found in the registers before putting down the results is carried out in the following order: the erroneous entry is crossed out, and the correct amount is given above the crossed out one. If an error is found in the journal - order after the totals are entered in it, but before they are entered into

Home book, the correction must be made after the total line.The necessary clarifications of the turnover are drawn up in a specially compiled accounting statement, the data of which are entered in

Home book separately.The change in turnover in the current month for transactions relating to previous periods is reflected in the journals - orders with an additional entry (decrease in turnover - red).

9. Permissible changes when printing forms of standard forms of magazines - warrants

When printing blank forms of journals - orders, based on the volume and content of the work, but without changing the basic principle of constructing standard forms, it is allowed:

9.1. Use the reverse side of the form, but do not continue the form from one side to the other. On each side of the form there must be a completed form of the journal - the warrant.

9.2. Increase the number of columns in the forms of journals - orders by adding new columns for corresponding accounts.

9.3. Print in a typographical way the numbers corresponding to the accounts in the corresponding columns of the form in a sequence convenient for the user (preferably in ascending order of numbers).

9.4. Enter the appropriate text in the columns reserved for related entries.

9.5. When printing the forms of magazines - orders, observe the following margin sizes: right - 20 mm; top - 18 mm; left - 8 mm; lower - 10 mm; as well as proceed from

tables sizes of the main details of journals - orders (p. 26).All changes allowed by paragraph 9 of the general instructions must be agreed without fail with the departments (departments) of accounting and reporting of the ministries of trade of the union republics, which is noted in the heading of the magazine - warrant when it is printed in a typographical way.

For enterprises and organizations of the Ministry of Trade of the RSFSR, the above allowable changes are agreed with the regional, regional, city departments of trade (public catering), the ministries of trade of the autonomous republics.

10. When printing in a typographical way forms of magazines - orders intended for keeping records on several accounts, they should be numbered in the order of the sequence of accounts, for example: magazine - order N 2/1 on the credit of account N 05, magazine - order N 2/2 on credit of account N 06, journal - order N 2/3 on credit of account N 07, etc.

11. The order of reconciliation of accounts by journals - orders

The construction of journals - orders and the order of their maintenance allow you to control the correctness and completeness of accounting records both daily and at the end of the reporting month.

Control is carried out by reconciliation of entries in accounting registers with corroborative and other documents (commodity and cash reports, State Bank statements, etc.). For example, debit and credit turnover, as well as the balance on the account "Goods" must be checked against the amounts of income, expenditure and balances of goods on the commodity accounts of financially responsible persons. This reconciliation is carried out as entries are made in the journal - the order and the statement on the "Goods" account. In the same order, the correctness of the entries in the accounting registers for the accounts "Cash", "Settlement account", "Special loan account for trade turnover", etc. is checked.

The correctness and completeness of accounting records is also controlled by comparing interrelated indicators reflected in different journals - warrants. Thus, the amount of goods received from suppliers in the debit statement on the account "Goods" is reconciled with the journal - warrant on the credit of the account "Settlements with suppliers and contractors". The data on the payment of suppliers' invoices contained in the journal - order for the loan "Special Loan Account for Goods Turnover" and the debit statement of the account "Settlement with Suppliers and Contractors" must be equal to each other.

The sums of the internal movement of commodity - material assets on the debit and credit of the consolidated journal on the account "Goods" must also be identical. The amounts of goods and other material assets shipped or released to buyers on the credit of the journal - the order "Goods" are reconciled with the debit statement on account 45 "Goods shipped, work performed and services". The retail value of goods sold (paid) on the credit of account 45 "Goods shipped, work performed and services" must be equal to the amount indicated in the corresponding column of the statement on the debit of account 46 "Sale". The data on the receipt of money from buyers for the goods shipped to them, contained in the statement on the debit of the account "Special loan account for turnover" and in the journal - warrant on the credit of the account "Realization", must be equal to each other.