One of the main conditions for the financial well-being of the enterprise is the inflow of funds to cover its obligations. The lack of such a minimum required cash reserve is indicative of his serious financial difficulties. Excessive amounts of cash indicate that the company actually suffers losses associated, firstly, with inflation and the depreciation of money, and, secondly, with the missed opportunity for their profitable placement and additional income. In this regard, there is a need to assess the rationality of cash management in the enterprise.

There are various ways to do this analysis. In particular, a kind of barometer of the emergence of financial difficulties is the tendency to reduce the share of cash in the composition of the company's current assets with an increasing volume of its current liabilities. Therefore, a monthly analysis of the ratio of cash and the most urgent obligations (which expire in the current month) can give a fairly eloquent picture of the excess (lack) of cash in the enterprise.

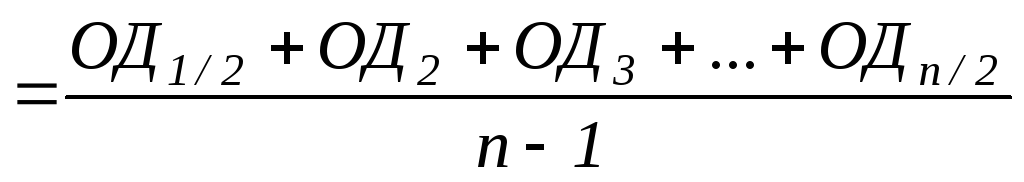

Another way to assess the adequacy of funds is to determine the duration of the turnover period. For this purpose, the formula is used:

The duration of the period is: 360 days - when calculating the value of the indicator for the year; 90 days - when calculating for a quarter; 30 days - per month. For the calculation, internal accounting data are used on the amount of balances at the beginning and end of the period (preferably a month) on cash accounts (50 "Cashier", 51 "Settlement, account", 52 "Currency account", 55 "Special accounts in banks") . For this, the formula

where OD- cash balances at the beginning of month n;

n is the number of months in the period.

To calculate the average turnover, you should use the credit turnover, cleared of internal turnover for the analyzed period, on account 51 "Settlement account", bearing in mind that most enterprises make non-cash payments with their counterparties, and the issuance of funds through the cash desk (for example, wages payment of employees or payment of business expenses) implies their preliminary receipt at the bank 8 .

The opening of special bank accounts and their use (checkbooks, letters of credit) at the expense of own funds is also associated with the transfer of funds from the current account to the corresponding special accounts. In these cases, the use of the amount of credit turnover on accounts 50, 52, 55 to calculate the amount of turnover would lead to a double count and, as a result, to a significant distortion of the cash turnover indicator at the enterprise. But if at the enterprise a significant part of the calculations goes through the cash desk (payment for products, services of suppliers and contractors is carried out in cash) and (or) special accounts are formed on a loan basis, i.e. If the amounts credited to accounts 50 “Cashier” and 55 “Special accounts in banks” are not previously reflected on account 51 “Settlement account”, then the indicated amounts of funds must be added to the amount of credit turnover on account 51 “Settlement account”. If it is difficult to form the value of the net cash turnover, you can calculate the turnover for each cash account (50, 51, 52, etc.) separately and, based on the dynamics of these indicators, draw conclusions about the change in the turnover rate of these funds. The calculation of the period of cash flow at the enterprise is shown in Table. twenty.

As follows from the data in Table. 20, the period of cash turnover during the year ranges from 0.92 to 2.16 days, in other words, from the moment money was received to the company's accounts until the moment they were withdrawn, an average of no more than 2 days passed. Apparently, this indicates a lack of funds from the enterprise, which is very dangerous with a significant amount of accounts payable. Any serious delay in payment can put the company out of financial stability.

In order to reveal the real cash flow at the enterprise, to assess the synchronism of the receipt and expenditure of funds, and to link the amount of the financial result obtained with the state of the funds, it is necessary to identify and analyze all directions of receipt (inflow) of funds, as well as their disposal (outflow) .

For the purposes of both internal and external solvency analysis, it is necessary to know how and from what sources the company receives funds and what are the main directions for spending them. The main purpose of such an analysis is to assess the ability of the enterprise to earn money in the amount and within the time frame necessary to carry out the planned expenses.

Table 20

Change in the duration of the company's cash flow

by months

|

Cash balances (according to railway station No. 1, 2, 3), thousand rubles |

Turnover per month thousand roubles. |

Turnover period, days ((gr.1 30) : gr.2) |

|

|

September | |||

In order to provide users of accounting information with data on historical changes in the enterprise's cash and their equivalents in the context of its main activities, the cash flow statement is used in international practice. Since 1996, the report of the same name has been included in Russian reporting in the form of f. No. 4.

In general, there are three main sections in the report: cash flow from current, investment and financial activities.

Under current understand the main statutory activities of the enterprise related to generating income. The inflow of funds in the framework of current activities is primarily associated with the receipt of proceeds from the sale of products, the performance of work and the provision of services, as well as advances from buyers and customers; outflow - with payment on the accounts of suppliers and other counterparties, payment of wages to employees , contributions made to funds social insurance and security, settlements with the budget for taxes due. Payment (receipt) of interest on loans is also connected with the current activity of the enterprise.

Cash flow in the context investment activity associated with the acquisition (creation) and sale of long-term property. First of all, this concerns the receipt (disposal) of fixed assets, intangible assets, long-term financial investments.

Under financial activities in international practice (in particular, in accordance with International Financial Reporting Standard No. 7) imply cash flows associated with changes in the composition and size of equity and borrowings of an enterprise (loans are understood here in a broad sense, including bank loans). Changes in equity in this section of the report are usually associated with the issue of shares or other monetary increase in the authorized capital, as well as share premium received. The change in equity as a result of the obtained financial result is not taken into account as part of financial activities, since expenses and incomes related to the formation of the financial result are taken into account in current activities.

Cash equivalents are equal to cash: short-term, highly liquid investments of the enterprise, freely convertible into cash and slightly exposed to the risk of changes in the market price.

It is fundamental that, according to international standards, the movement between individual items of cash and cash equivalents is not considered as a cash flow, but as a way to manage them. Therefore, such a movement is not included in the calculation of outflows and inflows of cash.

In foreign practice, a more detailed cash flow statement is drawn up, according to which the cash flow is highlighted in the context of current activities, taxation (payment of taxes), financial services (payment and receipt of interest, dividends), investment and financial activities proper.

When using information from the cash flow statement, the key indicator is the result of changes in cash from current activities (in practice financial analysis it is called net cash flow). This indicator judges the ability of an enterprise to generate cash as a result of its core activities. That is why it is important to separate the funds created at the enterprise from the funds attracted from the outside in the form of loans, additional contributions from owners, etc.

It should be borne in mind that the total change in cash over the period may be positive, the company may have satisfactory values of liquidity ratios, at the same time, the amount of net cash flow from current activities will be negative. This means that the result of the main activity of the enterprise is an outflow of funds, and their growth for the period is provided by financial or, less often, investment activities. If a similar situation for a given enterprise is repeated from period to period, it must be understood that there will come a time when it will not be able to repay its financial obligations, since the main stable source of repayment of external obligations is the cash flow from current activities.

According to International Financial Reporting Standard No. 7, an entity should report cash flows using either the direct method (according to which the report discloses the absolute amounts of receipts and expenditures of cash) or the indirect method (when net profit or loss is adjusted for the amount of non-cash transactions, transactions associated with the disposal of long-term assets, by the amount of change in current assets or current liabilities). The indirect method, therefore, allows you to move from the value of the financial result obtained to the indicator of net cash flow (total change in cash for the period).

The advantage of using the direct method is that it allows you to estimate the total amount of cash inflow and outflow of the enterprise, to see those items that form their largest inflow and outflow in the context of the three types of activities considered. The information obtained by using this method is used in cash flow forecasting.

There are the following ways to generate a report by the direct method:

the main method, which involves the use of accounting data on turnover by cash items. Recall that internal turnovers, i.e. the movement of funds between accounts, for example, from a current account to a cash desk and vice versa, are not considered as inflows (outflows) of funds;

the way in which each line item in the income statement is adjusted. For example, in order to obtain the absolute amount of cash receipts from buyers in the reporting period, the amount of sales proceeds must be adjusted for the amount of change in balances under the item receivables from buyers and customers.

If the sales volume for the period amounted to 1,000,000 thousand rubles, the accounts receivable of buyers at the beginning of the period - 350,000 thousand rubles, at the end of the period - 450,000 thousand rubles, then the amount of receipts from buyers will be 900,000 thousand rubles . (350,000 + 1,000,000 - 450,000).

Note that direct use of this method of compiling a report according to Russian financial statements is difficult, in particular because the profit and loss statement shows net sales proceeds (cleared from the amount of value added tax), while in the balance sheet, buyers' debt includes due from buyers VAT. The same adjustments should be made for cost items in order to eliminate the discrepancies associated with the formation of accounting expenses and the actual expenditure of the enterprise's cash.

It should be noted that the cash flow statement (f. No. 4) is quite different from the cash flow statement recommended by International Standard No. 7, Drafting f. No. 4 does not provide for the exclusion of internal cash flow, as a result of which the passage of one ruble, for example, twice, three times through cash accounts doubles, triples the amount of cash flow. Bearing in mind that this form is used for the purposes of making managerial decisions, in particular, for forecasting future receipts and payments, it can be argued that this simplified approach significantly reduces its analyticity.

Another problem is that all financial activity data in this form is reduced to cash flows as a result of short-term financial investments, the issuance of bonds and other short-term securities, the disposal of shares previously acquired for up to 12 months, etc. Such approach violates the logic of reporting, laid down in International Standard No. 7, according to which, as already noted, it is necessary to assess the ability of an enterprise to generate cash precisely as a result of current activities, and not activities in general. That is why it is necessary to separate those cash flows that arise as a result of current activities, and those associated with raising funds from outside, in particular in the form of loans.

Therefore, the receipt of loans and borrowings is usually reflected in the financial activity section. The exception is bank overdrafts, which in some countries are commonly referred to as cash management levers. In such cases, bank overdrafts are treated as current activities.

This approach, which provides for the separation of loans from current activities, is important from the point of view of information interpretation for both the creditor and the enterprise analyst.

The lender seeks to see separately the amounts attracted by the enterprise on a repayable basis and the amounts of cash resulting from current activities, bearing in mind that the amount must be secured from the main activities. In this case, we are talking about a general rule, and not about particular cases of solving the problem of solvency by covering some obligations through the emergence of new ones, refinancing debt, etc. Although these methods of ensuring solvency take place, they cannot be considered as a system. At a certain stage, the enterprise will face a situation where it will be impossible to obtain new financial resources on terms acceptable to it.

An internal analyst needs information about the amount of change in cash as a result of the current activities of the enterprise in order to resolve issues about the choice of investment policy, the use of profits for consumption needs, etc. These expenses should be planned primarily based on the enterprise's own capabilities.

There are other differences between the current cash flow statement in Russia and the report used in international accounting practice. So, one of the criteria for classifying an article as a current activity is its participation in the formation of the result from the sale of products. According to this, such an article as the remuneration of employees, being an integral element of the cost, is included in current activities. In the domestic form, this item is excluded from current activities (as, indeed, from all other types of activities), as a result of which the amount of payments for current activities is underestimated, and the amount of net cash flow is correspondingly overestimated.

In addition, for greater convenience of work in the form of a report, it would be necessary to provide for the final indicators of changes in cash from current, investment, financial activities.

The noted problems indicate that the direct use of this reporting form for analysis purposes is currently difficult, and the form itself needs further clarification.

I would like to note that the author's position is not to abandon the use of the cash flow statement prepared by the direct method. On the contrary, this report may contain very useful information for the purposes of current and prospective analysis of the company's solvency. It's about about making such a report suitable for analysis. To do this, the noted shortcomings must be eliminated in it.

The scheme of cash flow analysis by the direct method is shown in Table. 21.

According to Table. 21, the following conclusions can be drawn. The outflow of funds as a result of the current activities of the enterprise amounted to 295,800 thousand rubles. At the same time, the amount of receipts within the framework of the type of activity under consideration is 14,156,613 thousand rubles, of which receipts from buyers are 11,046,260 thousand rubles. (10,552,400 + 493,860), i.e. approximately 80% of the total cash inflow from current activities. Accordingly, about 20% of cash receipts from current activities were of a random, one-time nature.

Table data. 21 clearly indicate that the funds received were not enough to ensure the current payments of the enterprise.

Table 21

Cash flow in the enterprise

(direct method)

|

Line number |

Indicators |

The source of information |

Amount, thousand rubles |

|

1. Current activities |

|||

|

Cash inflow (receipts): | |||

|

proceeds from the sale of products, works, services |

Loan turnover, accounts 62, 90 in correspondence with cash accounts | ||

|

advances received from buyers and other counterparties |

Loan turnover c. 76 | ||

|

other income (refunds from suppliers; amounts previously issued to accountable persons, funds for targeted financing, etc.) |

General ledger, debit transactions 50, 51, 52 in correspondence with the account. 60, 71, 76, 96, etc. | ||

|

Cash outflow: | |||

|

payments on invoices of suppliers and contractors |

Turnover on debit c. 60 | ||

|

payment of wages (basic and additional) |

General ledger, debit transactions account 70 in correspondence with accounts 50, 51 | ||

|

transfers to social insurance and security funds |

Turnover on debit account 69 | ||

|

payment of funds to the budget |

Turnover on debit account 68 in correspondence with cash accounts | ||

|

advances issued |

Turnover on debit account 76 in correspondence with cash accounts | ||

|

payment of interest on a loan |

Operations on debit account 26 in correspondence with cash accounts | ||

|

consumption fund payments |

Turnover on debit account 86 sub-account "Consumption Fund", in correspondence with cash accounts | ||

|

short-term financial investments |

Turnover on debit account 58 in correspondence with cash accounts | ||

|

other payments |

Turnover on debit accounts 76, 96, etc. in correspondence with cash accounts | ||

Posted on the site 13.09.2012

Calculation of the credit limit - a necessary component credit analysis potential borrower. V currently there is no unified methodology, and each bank follows its own path. However, a number of general criteria for assessing the credit limit can still be identified. The development of a model for calculating the credit limit when issuing loans significantly reduces the likelihood of default by borrowers.

The relevance of the problem of calculating the credit limit for banks and customers

Banks have different approaches to the issue of setting limits, but usually credit limits are divided into the following groups: limits by regions (countries); industry limits; lending limits for one borrower. In this article, the main attention will be paid to the last group.

The issue of determining credit limits is one of the main issues of the credit process. The lack of a universal methodology for assessing the size of the credit limit is largely due to the fact that a generally accepted approach to solving this problem has not yet been developed. As a rule, the calculation of a potential borrower's credit limit is the result of an analysis of the client's financial condition, and its main idea is that the better the financial condition of a borrower, the greater the loan amount he can receive. In practice, this is not always the case, especially when it comes to SMEs and the reliability of reporting submitted by clients in this segment.

An excessively high lending limit may result in a default by the borrower and, as a result, the appearance of a problem asset in the bank's portfolio. The client, having overestimated his expectations intentionally or accidentally, simply will not be able to fulfill all his obligations in a timely manner, will begin to “intercept” money on the side in order to fulfill his obligations to the bank in a timely manner, thereby significantly increasing his debt load. In addition, in case of failure to fulfill part of their obligations to the bank, the client incurs fines, penalties, forfeits, the need to “strengthen” the collateral, and, consequently, the cost of appraisal and insurance, and as a result, all this entails a deterioration in credit history. It is possible that the client, choosing between paying the supplier or fulfilling his obligations to the bank, makes a choice in favor of the latter, then the deterioration of contractual relations with the counterparty and the increase in the reputational risks of such a borrower become inevitable. On the other hand, an underestimated credit limit will lead to a decrease in the profitability of the client's business, a slowdown in its development and the so-called cost of lost profits, or opportunity costs.

In fact, the definition of a credit limit can be considered as one of the tools for managing a loan portfolio. The purpose of establishing a lending limit is to ensure an optimal level of risk and speed up decision-making on individual lending transactions within the established limit.

Existing methods for calculating the credit limit

There are many different private and general, traditional and non-traditional methods for calculating the credit limit. Each bank, as a rule, uses one of the well-known methods or develops its own, based on the available intra-bank methods for assessing risks, liquidity, development strategies, etc. Most of the existing approaches are framework, approximate and are rather not justified estimates, but only expert guidelines. It seems most appropriate to consider the limit of possible lending based on peer review financial indicators, an assessment of the real cash flows of the enterprise for the possible repayment of short-term debt, an assessment of the financial position and, of course, the amount of security offered (if any is required).

The function of calculating the credit limit can be represented as formula (1). The min() function returns the minimum value from a set of passed values.

LC = min (OB, VO, FP, MVL), (1)

Where LK - credit limit;

OB - provision of the loan with liquid collateral;

VO - the possibility of servicing the loan;

FP - financial position;

MVL - the maximum possible lending limit within a particular loan product.

Credit Limit Calculation Model

Let's consider the application of this model with an example.

Example 1

Company A applies to the Bank for a loan to replenish working capital in the amount of 5,000 thousand rubles. At the same time, the client offers real estate as collateral with a collateral value (according to the valuation report of an independent appraisal company using an appropriate discount) of 4,500 thousand rubles. The financial position of the client is assessed no worse than "average". The maximum possible limit within the framework of providing a loan for replenishment of working capital is 25,000 thousand rubles.

Thus, if we rely only on the results obtained, according to formula (1), the lending limit will not exceed 4,500 thousand rubles.

If a loan is needed:

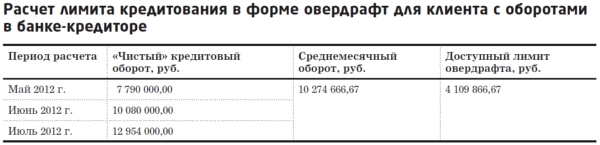

1) in the form of an overdraft, the credit limit is calculated, among other things, based on the available overdraft limit (30-50% of the "net" credit turnover on the client's account in the lending bank or another bank). At the same time, the limit value, as a rule, is not fixed and is subject to monthly recalculation based on the actual turnover for the previous three months;

Example 2

Individual entrepreneur Semenov K.A. in April 2012, he applied to the Bank with a request to issue an overdraft in the amount of 4,000 thousand rubles, while the current account with the individual entrepreneur was not opened with the creditor bank.

The calculation of the limit (Table 1) will be based on the data on the net average monthly turnover for the last six months in another bank. In this case, the term for setting the limit, as a rule, does not exceed three months. The available overdraft limit from turnover in another bank can be 25-35% (30% is assumed for the calculation example).

Table 1

From the table. 1 calculations show that the requested overdraft limit of 4,000 thousand rubles. will not be agreed and the amount will be reduced to 3,000 thousand rubles. In this case, this limit will be set for the entire duration of the overdraft without monthly recalculation. This happens because when opening an overdraft for a client from turnovers in another bank for a short time, it is agreed with him to transfer turnovers to the creditor bank for the period of the agreed limit.

Upon the expiration of the loan agreement IP Semenov K.A. again applies to the bank with a request to issue an overdraft limit in the amount of 4,000 thousand rubles.

The credit inspector carries out the calculation (Table 2). At the same time, “net” credit turnover for IP Semenov K.A. is taken into account. in the creditor bank for the last three months. The term of such a limit, as a rule, is 6-12 months. The available overdraft limit in this case will be 40-50% (40% is assumed for the calculation example).

table 2

Given in Table. 2 calculation showed that the available overdraft limit exceeds the one requested by the client. Thus, subject to the fulfillment of other conditions, the overdraft debt limit of 4,000 thousand rubles will be set for the client.

2) to secure the execution of a state (municipal) contract, to secure participation in a tender for the right to conclude a state (municipal) contract, directly to the execution of a state (municipal) contract, the lending limit will be determined based on the requirements of a particular loan product, the amount of participation security /execution of the state contract specified in the tender documentation/contract, expected receipts under the concluded state contracts, advance payments, the amount of the contract itself, etc. At the same time, the loan officer should carefully study the requirements for holding the tender (tender documentation), make sure that it is necessary to make a cash deposit as security for the borrower's application, and also familiarize themselves with the conditions for concluding a state contract in the event of winning the tender, the conditions for its further execution, the requirements for ensuring the execution of the contract, the availability of advance payments, payment terms;

3) for investment purposes, the credit limit is calculated based on the calculation of the investment project, the required investment amount, project payback, cash flow analysis for the lending period, etc. It should be noted that investment loans are provided to clients with a stable financial position, stable production and sales volumes, conducting profitable activities (not related to the implementation of an investment project), occupying a stable position in the market, having a positive credit history and successful experience in implementing investment projects.

Description of the main components of the limit calculation methodology

Let us dwell in more detail on the two parameters of formula (1): the possibility of servicing the loan and the financial position.

When determining the credit limit as a necessary component of credit analysis, the responsible bank officer must determine not only the current financial condition of the borrower, but also the ability of the borrower to meet its obligations in the future. The sources of repayment of obligations on the issued loan (interest, principal and other payments), the total debt burden both on existing loans/loans and on the newly issued loan and its relation to the free resources of the borrower are determined.

Thus, the possibility of servicing a loan is a comprehensive analysis of the borrower's activities for the previous period (usually 6-12 months) and a forecast for the lending period based on known information about the company's development plans, the intended use of credit funds, and the development of the industry where the potential business is present. borrower, the presence of seasonality, etc. For the purposes of such an analysis, it is necessary to build the so-called cash flow (for investment loans, loans for business development). If a lending limit in the form of an overdraft is determined or the purposes of lending are related to the conclusion/execution of a government contract or replenishment of working capital, the cash flow is usually not filled in and the possibility of servicing the loan is determined based on the calculation of the average monthly value of net credit turnover, the register of concluded contracts and expected income from them, the average monthly amount of revenue and net profit, etc.

To repay interest on the loan, free cash is used, which remains at the disposal of the borrower after all expenses for activities (both included in the cost price and not included in it) are paid. The main debt, as a rule, is repaid from the turnover of funds and is not included in the cost of goods/works/services. In this regard, the following situations are unacceptable: free net profit for the analyzed previous period of time is not enough to pay off interest on the loan being issued, and when compiling the forecast cash flow, the cash balance after paying all monthly loan obligations (principal, interest, commissions, etc.) d) is negative.

When determining lending limits for periods up to one year, it is advisable to consider the dynamics of net profit for the analyzed period and for the same period last year. The presence of losses reduces the possibility of servicing credit obligations and reduces the estimated credit limit, as it indicates the presence of a net cash outflow.

Analysis of the financial position involves the calculation of financial ratios, horizontal and vertical analysis of the client's financial statements for the periods preceding the date of applying for a loan (from one year to 6 months). The set of financial ratios for the model for assessing the financial position is individual for each bank and is included in the relevant intra-bank assessment system, developed taking into account the requirements of the regulator - the Bank of Russia.

As noted above, banks use different methods for setting limits on lending to a single borrower. There are two main types of credit limits for one borrower used in practice:

1) some banks prefer to set limits depending on the type of services provided to the client. In particular, the bank may open credit lines for the client with certain credit limits for certain types of activities: money market transactions, foreign exchange transactions, swaps and options. When separate limits are determined for each type of activity, a system of redistribution of limits between the operating divisions of the bank is often introduced. Such a system gives the bank the opportunity to continue lending operations in cases where individual operating units have exhausted credit limits, but the overall limit for units has not yet been selected;

2) other banks set an aggregate lending limit for one borrower, within which a client can be provided with several loan products in various types lending. The technology used by some banks is to establish both a basic limit on lending to one borrower and a limit on exceeding the basic limit, used in emergency cases, subject to the borrower's compliance with the benchmarks of the loan agreement. That is, by decision of the credit committee, a lending limit for one borrower in the amount of N can be set and it is possible to increase this limit to the amount of M in case of providing additional security, in case of an increase in turnover on the current account, and other conditions are met.

It should be noted that regardless of the type of credit limits set, the mechanism for their determination is unified: before making a decision on setting a credit limit, the main risk factors should be assessed using quantitative assessment methods (regression models). After that, based on the grouping of the analyzed indicators in descending order, it is possible to calculate the lending limit as a percentage of equity, the volume of the loan portfolio, or as a standard of absolute limit values for each group of specific borrowers.

conclusions

The model for calculating the credit limit presented in this article is extremely simple, but, as a survey of experts showed, it is precisely this kind of model that is used in most banks. In order to increase efficiency, the model for calculating the credit limit can be supplemented with a probabilistic model of the borrower's default. So, if the probability of default by a potential borrower exceeds the level acceptable for the bank, the credit limit can be reduced to zero or reduced. In addition, if the bank has appropriate intrabank models, it is possible to set a lending limit, including based on the borrower's credit rating. But in this case, in the process of setting a credit limit for the "old" borrower, it will be necessary to calculate the credit rating change matrices, which assess the probability of a change in creditworthiness class over time. The construction of such matrices by Russian banks would make it possible not only to qualitatively improve the level of assessing the creditworthiness of borrowers, to bring the norms of intrabank analysis in line with international standards, but also to obtain a more adequate assessment of the financial position of the borrower and assess its real capabilities.

Thus, the development of a model for calculating the credit limit when issuing loans is a necessary process, and the more responsibly banks approach this problem, the more noticeably the probability of default by borrowers will decrease due to incorrect - overestimated or underestimated - calculation of the limit for the provision of credit funds by potential and existing borrowers.

Yu.V. Efimova, BALTINVESTBANK OJSC, Small Business Department, Head of Business Loans Department, Ph.D.

Page 2

If there are both receivables and payables on the synthetic account, the account becomes active-passive. Therefore, in order to determine the balance on these accounts, one cannot limit oneself to comparing the sums of debit and credit turnovers on synthetic accounting accounts, since the amounts credited to debtors cannot be offset against accounts payable to other enterprises. The balance can be displayed in an analytical context, i.e. for each business, person or payment.

If the balances are entered correctly, then the balances on account 00 should be zero, and the sums of debit and credit turnovers are equal.

With the journal-order form of accounting, entries in the General Ledger are made on the basis of the data of the journal-orders. In the last entries are made as documents are received or the results for the month from the accumulative statements. At the end of the month, the results from the journals-orders are transferred to the General Ledger, where for each account the credit turnover is reflected in one amount, and the debit turnover - in correspondence with credited accounts. The sums of debit and credit turnovers on all accounts must be equal. Thus, in the General Ledger, current accounting data is summarized and records for individual accounts are mutually verified.

Reconciliation of the correctness of keeping records in the order journal occurs by comparing the totals for debited accounts with the total for the credit of the account. Reconciled monthly totals from order journals are transferred to the General Ledger. The credit turnover on the account is transferred from the corresponding journal, and the debit turnover - from other journal-orders on the corresponding accounts, thus, the debit turnover of the account is deciphered in the General Ledger, and the credit turnover is deciphered in the journal-order. The general ledger is maintained correctly if the sums of debit and credit transactions, as well as debit and credit balances, are equal. With this form of accounting, multiple entries are excluded and statistical and analytical accounting is combined.

GENERAL BOOK is an accounting register designed to maintain synthetic accounting throughout the year. It opens all synthetic accounting accounts used in the enterprise. The balance is recorded on the accounts as of January 1, the total data of order journals are registered monthly, the monthly turnover and the balance at the end of the month are displayed. At the end of the month, the totals from the journals-orders are transferred to, where for each account the credit turnover is reflected in one amount, and the debit turnover - in correspondence with credited accounts. The sums of debit and credit turnovers on all accounts must be equal.

The log-orders and their annexes contain ready-made data for financial statements. The general ledger is opened for one year and is maintained on synthetic accounts on the debit basis of business transactions. It shows the initial balance for each account, the debit turnover for the month being taken into account in the context of the corresponding accounts, the credit turnover - in one entry (the total amount) and the final balance. This book is made mutual verification entries in accounts. The sum of the debit and credit balances (initial and ending), as well as the sum of the debit and credit turnovers on the ledger accounts, must be equal. A simplified form of accounting is used for small businesses using a working Chart of Accounts with a reduced number of them and consists in maintaining all operations in the Book of Accounting for Business Transactions and the Payroll Record. When using property accounting registers, the following statements are used: accounting for fixed assets and accrued depreciation, accounting for inventories and finished products, accounting for settlements, accounting for sales, accounting for settlements with suppliers, accounting for cash, accounting for production costs and accounting for wages. Monthly, the results of activities are summarized in the so-called checkerboard and on its basis a turnover sheet is compiled, which serves as the basis for compiling the balance sheet.

The general ledger is maintained on a debit basis. In it, debit turnovers are transferred from different order journals, and then the total debit turnover of the corresponding account is calculated. Credit turnovers are transferred from different order journals as a total amount. In the General Ledger, each account shows the balances at the beginning and end of the month. The correctness of the entries in the General Ledger is checked by counting the turnovers and balances of all accounts. The sums of debit and credit turnovers and debit and credit balances must be equal, respectively. On the basis of the final balances in the General Ledger, a balance sheet is compiled.