- 1c accounting

- 1C: Salary and personnel management

The dream of almost any manager is to find a reliable accountant, thanks to whom you can not delve into accounting. But it is impossible not to control the activities of the accountant at all. As one of the key figures in a company, an accountant can cause significant damage to its business reputation - both in the eyes of partners and in the eyes of regulatory authorities. Tatyana Zolotykh, head of 1C-PraToN, told the website about how to monitor the state of affairs in the accounting department on an ongoing basis with the help of fairly simple tools.

Trust - and verify

In many companies, the work of ordinary personnel is monitored more carefully than the activities of an accountant. But he is one of the key figures in any organization. And the presence or absence of claims from regulatory authorities and business partners depends on his work.

You can check managers, storekeepers, suppliers, and any other employee almost immediately after hiring. The opportunity to assess the activities of an accountant does not always arise and not immediately.

Outwardly, it may be that the documents are in order, the reports have been submitted, taxes have been paid. But then it turns out that the taxes were paid by the wrong ones or by the wrong requisites, and the reporting was handed over to the wrong one or not at all.

An audit helps to identify emerging or long-standing problems in this area. But the director or owner is not always ready to order it. In such cases, they are guided by the following logic: “If there are no big problems in my accounting department, it turns out that the money for the audit will be wasted. Why do I need an audit if I have a competent chief accountant, to whom I pay normal money? " As a result, no audit is performed, and serious problems remain invisible for the time being.

The main reason for emergency and crisis situations in the company's accounting is the director's unconditional trust in his accountant

The reasons for this unconditional trust are given as follows: "Our accountant is such a sweet woman - she cannot cheat", "The accountant is a real professional, and will give odds to any auditor." But if this confidence is based, for example, on the recommendations of acquaintances, there are risks of biased and incorrect assessment.

Sometimes the manager thinks he is in the know about accounting. As a rule, he keeps a separate accounting of income and expenses from the accounting department, he himself signs each payment in the client-bank. At the same time, the accountant not only maintains the company's document flow for transactions, but also calculates taxes and salaries, and performs other accounting functions. With this scheme, the two information spaces, the director and the accountant, are decoupled. And the director may not even imagine what is really going on in the accounting department.

In order to effectively control the work of an accountant, the "1C: Accounting" program provides the manager with fairly simple tools. Having mastered them, you can get an objective picture of the effectiveness or inefficiency of the accountant.

Seven easy ways to control your accounting work

I.

Check the status of settlements with counterparties

This will ensure that the accountant records receipts, expenses and payments in full. Also, their reflection in the accounting of business transactions is checked. With high-quality work of an accountant, all payments must be made, as well as all the necessary documents for the receipt of goods, works and services.

The manager is recommended to monitor the counterparties' debts once a month. To do this, in the "1C: Accounting" program in the "manager" section, it is enough to generate a report on the debt of buyers and suppliers. The program shows what happened in mutual settlements at the beginning and end of the period when there was a decrease or increase in debt. Advances are also taken into account - spent and unearned. For individual transactions, you can selectively check the documents - make sure they are in order. The identified shortcomings will serve as a signal for a more detailed verification of documents.

The manager should pay special attention to old debts, as well as to "strange" counterparties. The "old" debts are those for which there was no movement for the entire reporting period. The older the debt, the more difficult it is to recover it. It is also possible a situation in which there is no longer a debt, but no documents have been posted on it.

In "1C: Accounting" there is also a mechanism for checking counterparties. It allows you to find out in what state the counterparty is, whether its checkpoint is valid. If the KPP is no longer relevant, then the company may be in the process of liquidation. This information comes directly from the portal of the tax office.

Documents that raise concerns about the counterparty are highlighted in red by the program. This means that the counterparty is either in the stage of reorganization, or he has some of the details filled in incorrectly, or he is no longer listed in the registers of the tax inspectorate.

If the company has payments to a non-existent counterparty, then when filing a VAT return, the tax office will send a request to verify these payments. And in the future this can turn into penalties.

II... Check the movement of money in the current account

The director needs to make sure that there are no “unauthorized” payments. Leaders are now very wary of the first signature key. But there is still a practice when a manager, wanting to free his time, transfers the key directly to the accountant. In this case, the accountant may send payments through the wrong channel.

Sometimes an accountant says that he needs a key to prepare payments. Now the bank has a "technical" key. It allows you to prepare a payment, view statements and upload them to 1C. But without the director's signature, the program will not send a single payment. Thus, you can stop dubious or incomprehensible payments.

Case from experience. The accountant arbitrarily transferred the amount to herself from the company's current account, having the right of the first signature in her hands. She explained this by the fact that the manager does not value her and pays little. And she decided to give herself a prize in order to "restore justice."

At the end of the reporting period, you need to check the balance of the current account in the 1C: Accounting program. Now the tax authorities have the right to request the movement of current accounts directly from the bank. And for the bank's failure to provide certificates on the availability of bank accounts and (or) on the balances of funds in the accounts, extracts on transactions on accounts with the tax authority in accordance with paragraph 2 of Article 86 of the Tax Code of the Russian Federation, special responsibility of the bank is provided. Therefore, it is important that all key indicators that are sent to external regulatory bodies converge.

Receipts, the receipt of which was not expected, may also be of interest to the manager. They do not always need to be happy, and their origin should be clarified with the accountant. It may be that the accountant, at the request of some other organization, accepted non-cash money from it. Then he withdraws these funds in cash at the bank, takes his remuneration and transfers the remaining amount to the intended purpose (most often returns it back to a third-party organization).

But the withdrawn cash must also be sent through the cashier. If relatively small funds can be written off for business or travel expenses, then a more or less large amount is more difficult to write off.

III.Check the cashier

Cash is often handled quite freely by staff. They can be spent here and now, and the supporting documents can be planted tomorrow or never. If some employees have access to the cash register, they are able to borrow money and not return it. In addition, it is on this “site” that tax inspections are most often audited (the so-called “cash discipline check”). And the fines for violations of the rules are severe - they start from 40,000 rubles.

To check the cash register, you need to ask the accountant for the cash book. He should keep it in a printed form. And there should not be a minus at the checkout under any circumstances.

The director of an enterprise is sometimes told that “in modern accounting, everything is possible,” including a negative cash balance. The balance may be negative because the counterparty did not pay on time or the employee did not report for some amounts. But there can be no minus at the box office. Otherwise, it means that more money was spent than was available.

One of the most common pitfalls in which the organization is driven by chief accountants is the lack of loan agreements. When a cash gap occurs, the owner usually contributes his own personal funds. The accountant arrives, sends them to the current account and uses them for their intended purpose. In these cases, it is necessary to draw up a loan agreement, otherwise its absence may be revealed at the most inopportune moment.

Retail cash receipts cannot be used to repay the debt. According to the instructions, this money must first go to the company's current account. And then, having formalized them as a target expense to repay the loan, you can withdraw this money or transfer it to the card. For violation of this order, you can receive a fine from the regulatory authorities.

If money was issued "on account", there must be advance reports. This is a rather complex document that requires accounting knowledge. But the manager can always check whether he signed these reports or not. It is also not difficult to see which checks and for which expenses are attached there. One of the accountants, for example, attached checks for manicure and gasoline for a personal car to the report. To the director's question, the accountant said: "Well, I go to work!" The director was surprised to learn that this expense item had been included in his company for a year and a half.

Many businesses leave the cash register and transfer all payments to a non-cash form. This is a promising and convenient form, when any money (salary or "on account") the employee receives on the card. Staff can use corporate reporting cards to spend corporate money. In this case, you will not have to control the turnover of cash at all.

IV.Check warehouse

The warehouse is checked not by the actual availability of goods on it, but by accounting. Turnovers can be outsourced to an accountant, but balances on goods and materials should be checked. The results obtained will also be reflected in the balance sheet, which then goes to the tax authorities.

The most important "signal" - negative balances - can be checked with a convenient report. In "1C: Accounting" in the "Warehouse" section there is a report "Control of negative balances". If you form it for a certain period, you can avoid situations in which the goods are sold, but not recorded by the accounting department. Otherwise, this will lead to overstatement of taxes: the amount spent on the purchase of goods will not be deducted from the tax base.

The remaining warehouse balances can be checked against the balance sheet. The following points can be seen in it.

Materials are bought, but not written off... This happens when documents from the supplier are transferred to the accounting department. And the accountant does not post the invoice according to which these purchases are included in expenses and reduce taxable profit by this amount.

Goods are bought, but not written off as they are, but as they should... That is, not all expenditures or not all income are “spent”. In this case, at the end of the period, there are balances that are not secured by the physical availability of goods in the warehouse. During a tax audit, the company will not be able to present the goods that are listed in the financial statements.

V... Check tax calculations

It often happens that a certificate from the tax office, according to which the reconciliation of settlements is carried out, does not correspond to the data that is reflected in the accounting records. Accounting data is submitted to the regulatory authorities at the end of the year, and this discrepancy will still be noticed there.

It happens that there is either a tax arrears or an overpayment. The accountant, not wanting to deal with the previous history of payments, calculates taxes in the current period without taking into account overpayments or past debts. There is a discrepancy that grows and accumulates over time. As a result, it turns into a claim from the tax office.

It is not difficult to control this situation - you need to check the balance at the end of the period in the balance sheet. This amount must match the payment, which is not always the case.

There is one more peculiarity of working with tax authorities. The more time passes from the moment of overpayment of one or another tax, the less willingly the tax authority refunds the overpayment. If the overpayment occurred earlier than 3 years ago, it is almost impossible to return it. But if there is a tax debt for any period, the tax will demand it.

The amounts in tax requirements should be checked against the payment, which is signed by the bank. This amount must match the tax return. All declarations contain a line “amount of tax paid for the current period”. And this balance must coincide with the declaration, if the company does not have any overpayments or debts. If there are discrepancies, this is a reason to ask the accountant about overpayments or arrears.

Case from experience. LLC operates on a common taxation system. The director liked that the accountant always "competently" calculates the amount of taxes, and the amount she provides is in line with his expectations. In practice, it happened like this. The accountant counted taxes for a given period, brought the calculation to the director, who asked to “make” a different amount there. The accountant corrected the calculation and brought a report with the desired result.

When 1C: BuhService launched a free express audit campaign, the client ordered this service. As a result, it turned out that the OKVEDs of the five largest suppliers did not correspond to the cost items carried out by the accountant. The director knew nothing about these "suppliers". One of the counterparties was completely liquidated. It turned out that the “necessary” tax amount was “adjusted” by the accountant due to gross accounting errors.

VI... Check compliance with legal regulations

To check them, you need to know them. But mastering all the legislative subtleties is difficult even for a lawyer. And here the program "1C: Accounting" itself comes to the rescue. You only need to press two buttons so that the program itself checks the compliance with legal regulations.

Technical errors can be seen using the express check in the "Reports" section. She monitors the general state of affairs from the point of view of legislation for each area of accounting: both in accounting, and in cash, and in maintaining a book of purchases and sales.

If there are accounts with negative balances, which, according to the law, should not be, then the program will inform you about this. It will show in what period, by what account and where exactly the negative balance was formed.

The program also checks the absence of negative cash balances. She will tell you which days there are errors and how much. She will also signal a violation of the limits on cash settlements with counterparties: with whom and for what amount.

The third point that can be checked is the chronological sequence of receipt of incoming and outgoing cash orders. This is also a legal requirement.

Vii... Check the calculation of taxes for the current period

In the program "1C: Accounting" you can see how many taxes have been charged, as well as whether all expenses were taken into account when calculating the taxable base and what exactly the accountant forgot to include. Thanks to this, you can understand how accurate the accountant is and is interested in the company not overpaying unnecessary taxes.

All that remains is to check the amount of taxes and compare it with expectations. Without going into the peculiarities and nuances of the tax code, the manager himself can estimate the amount of tax payments with a sufficient degree of accuracy. Using the simplest formula, you can calculate "tax expectations" and compare them with the data provided by the accountant.

In the section "Accounting, taxes, reporting" for each tax there is a report. In a simplified system, this is an analysis of the state of tax accounting. If we are talking about the general system, then the program contains calculations for VAT and income tax. From them, you can see the principal amounts for key business transactions: receipts, revenues, returns, expenses, etc. After that, the difference between income and expenses becomes visible. This amount (if we are talking about simplification) and will be taxed.

You can also check whether the accountant took all the expenses into account. The report shows the amount that remained unrecognized when calculating the taxable base. This is the amount of expenses that the accountant forgot to take into account in his tax calculations. In fact, the taxable base can be reduced by this amount.

Case from experience. A small enterprise, with an increase in turnover, invited an accountant. Friends advised him. Prior to that, the company did the bookkeeping on its own in order to save money. With the advent of the accountant, the owner continued to add the bank to the 1C: Accounting program himself. The manager wrote out the documents. Outwardly, from the point of view of the owners of the company, everything looked stable and normal. But when, after 10 months, a demand came from the Federal Tax Service and the account was blocked, it turned out that the accountant was submitting zero reports.

She explained this to the manager by the fact that her program had "failed." Because of this, the reporting is not formed, and it cannot submit deliberately incorrect reports. On the recommendation of the accountant, the director opened another company, and six months later he received the same story with zero declarations. As a result, they had to hire a new accountant and start all over again.

But the main loss was the company's business reputation. When reconciliation of settlements with counterparties was carried out, there was a lot of negativity from the side of suppliers. The company (together with 1C employees) had to spend a lot of effort to restore its reputation.

P.S.

Using the methods described above, you can "measure the temperature" in the accounting department of the enterprise. Such a diagnosis allows you to understand whether everything is fine with regard to finances, or whether you need to "call a doctor." If you suddenly discover some disturbing moments, and you would like to check them more carefully, you can use the services of rescuers from 1C by ordering a free

In an article by Ph.D. Art. Lecturer at the Department of Accounting, Analysis and Auditing, Faculty of Economics, Moscow State University. M.V. Lomonosov, consultant-expert on accounting V.Yu. Savin and Professor S.A. Kharitonov are considering the possibilities of the "1C: Accounting 8" program to check the correctness of accounting, tax accounting for income tax and value added tax.

After completing all the regulatory operations for closing the period, it is required to check the correctness of the received accounting data, according to which the regulated reporting on accounting, tax accounting for income tax and tax accounting for value added tax will have to be generated and submitted to the tax authorities.

The following special system reports can help the user:

- report ;

- report ;

- report ;

- report .

Report "Express check of accounting"

Report Express check of accounting is in the menu Reports -> Express check of accounting.

Go to setup), you can select four groups of checks provided by the report:

- verification of compliance with the provisions of accounting policies;

- checking the conduct of cash transactions;

- checking transactions related to keeping the sales ledger;

- checking transactions related to the maintenance of the purchase ledger.

Checks are started by pressing a button Check.

Consider the checks included in each of the four groups.

Accounting policies

Inspection group Accounting policies combines eleven checks.

A complete list of checks of this group and comments to them are presented in Table 1.

If the accountant is not sure whether it is necessary or not necessary to perform a specific check, then the check sign can be left for it.

The program will independently analyze the conditions necessary for performing individual checks. If verification is not required, then an error message will be displayed.

Table 1.

Audits of accounting policies

|

№ |

Name |

Item |

Conditions under which the check is performed |

|

Availability of the accounting policy of the organization for accounting and tax accounting |

Availability of entries in the information register |

||

|

Availability of accounting policies for personnel |

The presence of an entry in the information register |

If in the settings of accounting parameters it is indicated that calculations by personnel are carried out in "1C: Accounting 8" |

|

|

Consistency of accounting policies throughout the year |

|

||

|

Consistency of the accounting policy for tax accounting during the year |

Lack of entries in the register |

||

|

Compliance of the method of valuation of goods in retail with the use of goods accounting accounts |

For the method of evaluating goods at retail "By purchase cost", the absence of balances and turnovers on accounts 41.11 "Goods in retail trade (in ATT at selling value)", 41.12 "Goods in retail trade (in NTT at selling value)", 42 " Trade margin " |

If it is indicated in the accounting policy settings that the organization conducts activities related to retail trade and accounts for goods in retail At acquisition cost |

|

|

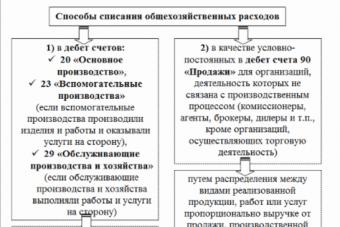

Compliance of the application of the direct costing method with the actual closure of the account 26 |

If the direct costing method is used, it is verified that account 26 is closed to account 90. If the direct costing method is not used, it is verified that account 26 is closed to accounts 20, 23, 29. |

If in the settings of the accounting policy it is indicated that the organization conducts activities related to the production of products and (or) the performance of work, the provision of services |

|

|

Compliance of the application of PBU 18/02 with the use of the corresponding accounting accounts |

The absence of balances and turnovers on accounts 09 "Deferred tax assets", 77 "Deferred tax liabilities", 68.04.2 "Calculation of income tax" and subaccounts 99.02 "Income tax" |

If in the accounting policy settings, the checkbox is cleared. PBU 18/02 is applied. Or |

|

|

Non-application of PBU 18/02, subject to the application of the simplified tax system |

Checks that the checkbox is not checked PBU 18/02 "Accounting for income tax calculations" is applied |

If it is established in the accounting policy of the organization that the organization applies |

|

|

Absence of movements of tax accounting registers for income tax in the case of application of the simplified tax system |

The absence of movements in the registers intended for tax accounting for income tax is monitored |

If it is established in the accounting policy of the organization that the organization applies |

|

|

Absence of balances and turnovers on UTII accounts in case of non-application of UTII |

The absence of movements on accounting accounts, directly or indirectly related to UTII, is monitored |

If the checkbox is not checked in the accounting policy A special taxation procedure is applied for certain types of activities |

|

|

Compliance of the existence of transactions that are not subject to VAT or are taxed at the rate of 0%, accounting policy |

The absence of turnovers on subconto on account 90 "Sales" is monitored VAT rates with values Without VAT and 0 % |

If the checkbox is not checked in the accounting policy The organization carries out sales without VAT or with VAT 0% |

Cashier operations

Inspection group Cashier operations combines eight checks.

A complete list of checks of this group with comments is presented in Table 2.

Table 2.

Checkout transactions

|

P / p No. |

Check name |

Item |

A comment |

|

Absence of unfilled cash documents |

The absence of unpost incoming and outgoing cash orders is checked, except for those marked for deletion |

Cash transactions using documents Receipt cash order and Account cash warrant c are made out in two stages: In the information base of the "1C: Accounting 8" program, an unposted document is created, from which the completed primary document is printed; After the cash transaction is actually completed, the electronic document is posted, the cash flow is reflected in the accounting accounts. |

|

|

No negative balances |

The balance on the account 50 "Cashier" at the end of each day is checked. The account balance must not be negative. |

Check for the absence of negative balances on account 50 "Cashier". Such errors can be caused by late registration of cash transactions. |

|

|

Compliance with the cash balance limit |

The excess of the balance on account 50 "Cashier" at the end of each day in which there was a movement on the account, the established limit of the cash balance is checked |

When reporting exceeding the limit, it should be borne in mind that in excess of the established limits, enterprises have the right to keep cash in their cash desks only for remuneration of labor, payment of social security benefits and scholarships. The cash limit at the cash desk is entered into the information register Cash balance limit, menu Cashbox - Cash balance limit. |

|

|

Compliance with the limit of cash settlements with counterparties |

The amounts of cash transactions, in which the settlement account is indicated as the corresponding one, are checked for exceeding the maximum amount of cash settlements under one agreement |

From 21.07.2007 the maximum amount of settlements in cash under one agreement is 100,000 rubles. |

|

|

Compliance with the numbering of PKO and RKO |

The numbering of PKO and RKO should be strictly in chronological order. |

Failure to comply with the chronological order of numbering for documents having the same date but different creation times is not considered a violation |

|

|

Issuance of money for the report only after the report on the previously issued amounts |

For each cash transaction, in which account 71 "Settlements with Accountable Persons" is indicated as the corresponding one, the absence of debt as of the date of the transaction is checked |

Cash withdrawal on account is made only on condition of a full report of a specific accountable person on the advance payment previously issued to him |

|

|

Lack of transfers of accountable amounts from one person to another |

The absence of internal turnovers with different corresponding subconto (objects of analytical accounting) on account 71 "Settlements with accountable persons" |

It is forbidden to transfer cash issued on account by one person to another |

|

|

Issuance of money under the account only to employees of the organization |

It is checked whether the person to whom the cash is issued against the account is an employee of the organization on whose behalf the cash order was drawn up |

One infobase can keep records for several organizations. At the same time, for the analytical accounting of settlements with accountable persons, a single reference book is used Employees of organizations what can cause this error |

Maintaining a sales ledger for value added tax

Perform maintenance check Sales books

Inspection group Maintaining a sales ledger for value added tax combines seven checks.

The list of checks of this group, as well as comments to them, are presented in Table 3.

Table 3.

Sales ledger maintenance checks

|

P / p No. |

Check name |

Item |

A comment |

|

VAT, Settlements with counterparties, Assessment of inventories at disposal |

Date of accounting actuality, then the installation and editing of parameters should be done through the menu Service - |

||

|

Completeness of issuing invoices for sales documents |

For organizations that are VAT payers, each posted sales document must be accompanied by a posted invoice |

||

|

Timeliness of issuing invoices for sales documents |

An invoice for sales transactions must be issued no later than five days from the date of sales |

||

|

Document availability |

Documents to be posted Formation of records of the sales ledger in each tax period in which there are advances for recovery. |

||

|

Checking the formation of advance invoices in the presence of advances received |

In case of receiving advances from buyers, invoices for the amount of advances received must be issued and posted on the same date |

When checking, it turns out: 1. Are invoices issued for all advance receipts? 2. Do the accruals on account 76.АВ correspond to the amounts in the register? VAT on advances. 3. Whether the amounts of VAT on the received advances are the same according to the accounting data and in the sales ledger. |

|

|

Completeness of reflection in the sales book of VAT amounts to be transferred by a tax agent (lease of state property or foreigners not registered in the Russian Federation) |

The amount of VAT to be transferred by the tax agent (for the lease of state property or for foreigners who are not registered in the Russian Federation) must match, for accounting and for the sales book |

The need to fulfill the duties of a tax agent under a specific contract is recorded in the properties of the contract (reference book Contracts of counterparties). When registering debts under such an agreement in the program, an accounting entry is automatically generated for the amount of tax to be withheld and paid to the budget. In this case, an invoice is issued for the calculated amount of tax (using a document Invoice issued), which is registered in Sales book... The subject of the audit is control over the compliance of accounting data and VAT tax accounting. |

|

|

Completeness of reflection in the sales ledger of VAT on construction and installation works (CMP) performed in a commercial way |

The amount of VAT accrued for construction and installation work carried out in a commercial way, for accounting and for the sales book must be the same |

Maintaining a book of purchases for value added tax

Perform maintenance check Shopping books follows at the end of each tax period (VAT tax period - quarter).

Inspection group Maintaining a book of purchases for value added tax combines seven checks. A complete list of checks of this group with comments is presented in Table 4.

Table 4.

Purchase ledger maintenance checks

|

P / p No. |

Check name |

Item |

A comment |

|

Control of the date of accounting relevance |

For the correct operation of the VAT subsystem, the date of relevance by sections: VAT, Settlements with counterparties, Assessment of inventories at disposal, must be either not set or not earlier than the end date of the verification period |

In the event that the organization decides to use the mechanism of the system Date of accounting actuality, then the setting and editing of parameters should be done through the menu Service - Accounting actuality date management |

|

|

Completeness of receipt of invoices according to receipt documents |

Each receipt document received from counterparties who are VAT payers must be accompanied by an invoice |

It is monitored so that for each receipt document either in the document itself or using the document Invoice received the invoice presented by the supplier was registered in the infobase |

|

|

Document availability |

If the accounting policy includes the possibility of selling without VAT or with VAT 0%, there must be a posted document Allocation of VAT indirect costs in each tax period |

If the accounting policy settings are set to support separate VAT accounting. Then at the end of each tax period with a document Allocation of VAT indirect costs the distribution of the amounts of VAT charged between different types of activities and sales should be made. |

|

|

Correctness of distribution of VAT on indirect costs |

The amount of indirect expenses received during the tax period (income according to the register VAT on indirect costs), should be equal to the sum of the distributed among the types of activities with different VAT taxation (expenses according to the register VAT on indirect costs) |

||

|

Document availability |

There must be a posted document Formation of purchase book entries in each tax period for VAT |

||

|

Absence of negative balances of VAT amounts claimed by suppliers |

There should be no negative register residuals VAT charged |

The amounts of tax presented for payment by suppliers and paid to suppliers are automatically recorded in the register in the program VAT charged. The presence of negative amounts in the register VAT charged can be caused, for example, by the fact that the goods for which VAT was accepted for deduction in the period of receipt, in the next tax period was sold at the VAT rate of 0%. The user did not complete a routine VAT recovery operation. |

|

|

Availability of VAT deduction from advances when offsetting advances received |

If there are transactions to offset advances from buyers, there must be transactions deducting VAT charged on these advances |

In accordance with paragraph 8 of Article 171 and paragraph 6 of Article 172 of the Tax Code of the Russian Federation, the tax amounts calculated by the taxpayer from the amounts of payment, partial payment received on account of the forthcoming deliveries of goods (works, services) are subject to deduction from the date of shipment of the corresponding goods (works, services) |

Report "Analysis of the state of accounting"

Report Analysis of the state of accounting is in the menu Reports -> Analysis of the state of accounting.

Going to the settings menu (button Customization), the accountant can select on the tab Settings There are four types of inspections provided by the report:

- Analyze the working chart of accounts;

- Analysis of accounts to be closed;

- Analysis of accounting results;

- Analysis of accounting entries.

By default, all four types of checks are performed, but since the full analysis takes a long time, you can disable those that are not required.

The user can make adjustments to the standard settings for recognizing transactions as "invalid" - tab Invalid postings(fig. 1).

Rice. one

In a collumn Dt indicates the debit account of the invalid transaction, in the column CT- credit account. In a collumn Exception and Exception you can specify accounts that are excluded from verification.

For example, if the column Dt the account is "01", and in the column Exception indicated "01, 08, 79, 83" - this means that all entries on the debit of account 01 are incorrect, if the corresponding account is not from the list "01, 08, 79, 83".

Column A comment stores an explanation of the posting comment. If the program detects an invalid wiring, then the text from the column will be displayed in the report A comment.

On a bookmark Reference PS a reference self-supporting chart of accounts is displayed, which is used to analyze the correctness of maintaining the user's chart of accounts. The user should not change the information on this tab.

The settings made by the user are saved by the button OK.

To perform the selected checks, press the button To shape.

If there are errors in any section of the report, by double-clicking on the line with the error, you can call up the account card or the transaction form with the erroneous posting.

Let's take a closer look at each of the four types of checks provided by the report.

Analyze the work chart of accounts

The program compares the working chart of accounts with the reference chart of accounts recommended by 1C. Information about the reference chart of accounts is presented on the tab Reference PS report settings menu.

If the required account is not found in the chart of accounts, the activity sign has been changed for the account, and warnings will be issued. It also checks the structure of analytical accounting on the accounts involved in the algorithms for drawing up regulated reporting forms.

Analysis of accounts to be closed

The accounting results at the end of the reporting period are checked. If the accounts to be closed at the end of the reporting period have balances, information on such accounts is issued.

For example, they should not have a balance on the account as a whole at the end of the period of account 25 "General production expenses", 26 "General expenses", 90 "Sales", 91 "Other income and expenses".

The balance on such accounts is checked, and if it is found, the report displays a message about the account number, account balance with explanations of the nature of the error.

Analysis of accounting results

In the process of performing the analysis of accounting results, the following are identified:

- erroneous account balances (highlighted in red in the program);

- errors in quantitative accounting (lack of balance in quantity or amount in the corresponding accounts);

- errors in the revaluation of foreign exchange funds at the end of the reporting period (for the correct operation of this section, it is necessary to set the exchange rate at the end of the reporting period).

Recall that one of the characteristics of the account (subaccount) of the chart of accounts is the attribute of the account in relation to the balance. In accounting, according to this characteristic, all accounts are divided into active, passive and active-passive. For example, account 01 "Fixed assets" is active, account 63 "Provisions for doubtful debts" is passive, and account 68 "Calculations for taxes and fees" is active-passive.

For active and passive accounts, the correspondence of the balance of the final attribute of the account is monitored (on the active account the balance must be on debit, and on the passive account - on credit).

In the "1C: Accounting 8" program, one of the operations for analyzing accounting totals is to check the fulfillment of this rule. If this is the case, then the report shows on which accounts the balances do not correspond to the account attribute.

The accounting of inventories in the program is carried out not only in monetary terms, but also in kind. For example, such accounting is provided on account 41 "Goods". Accounts that support quantitative accounting are marked with a check mark in the column in the chart of accounts Number.

A check is made for the correctness of the balances on such accounts. It is considered an error if there is a “sum” balance on the object of analytical accounting on such an account, but there is no quantitative balance, and vice versa: there is a balance in kind, but it has zero value.

For organizations with assets and liabilities, the value of which is denominated in foreign currency, it is useful to check the correctness of their assessment at the end of the reporting period.

For the preparation of financial statements, the value of these assets and liabilities is subject to recalculation into rubles at the exchange rate in effect at the reporting date. Accounts with the sign of support for currency accounting in the chart of accounts are marked with a check mark in the column Shaft.

Regular operation Revaluation of foreign exchange funds the balances on these accounts are recalculated, and the resulting exchange differences are included in other income or expenses. The program checks for the presence at the time of performing a routine operation on revaluation of assets and liabilities denominated in foreign currency, loaded into the database of the current exchange rate.

Analysis of accounting entries

The result of this check is a list of transactions "suspicious" from the point of view of the program. The criterion of suspicion is the list of invalid transactions presented in the report settings, on the tab Invalid postings... If an invalid posting is found, the program will display a line with an error, which will indicate which correspondence aroused suspicion and a short comment will be given.

If the accounting policy of the organization for individual accounts provides for additional offsetting accounts, "expanding the list of exclusions", they must be added to the list before performing the analysis.

Report "Analysis of the state of tax accounting for income tax"

The report Analysis of the state of tax accounting for income tax is located in the menu Reports -> Analysis of the state of tax accounting for income tax.

The report allows you to assess whether the organization maintains tax accounting and accounting for permanent and temporary differences in the assessment of expenses and income, assets and liabilities, as well as to find the source of discrepancies between accounting and tax accounting data.

When you open the report, the structure of the tax base for income tax is displayed (Fig. 2). With its help, you can go to the accounting section of interest. In the future, to return to the structure of the tax base on the command panel of any schema and table, press the button Tax base structure.

Rice. 2

It is advisable to start the analysis of the correspondence of correctness of data on tax accounting with the “Tax” block (Fig. 3). It presents an analysis of the state of tax accounting, in which the amount of income tax is compared according to tax accounting data (profit declaration) and according to accounting data, taking into account the recognition and write-off of permanent and deferred tax assets and liabilities (income statement). If the amount of income tax according to accounting data coincides with the amount of income tax according to tax accounting data, then tax accounting is regarded as correct - the result is marked with a green square.

Rice. 3

If the sums do not match, the program marks the result with a red square, which signals an error.

In this case, all blocks of the diagram, in which the program found errors in order to comply with PBU 18/02, will be marked with a red square in the report. The criterion for the correctness of the data is the rule: BU = NU + PR + VR. The mechanism for navigation between data and data decryption provided by the report will help to eliminate errors.

The blocks in the diagram are connected with each other by arrows that indicate the cause-and-effect relationship between operations. The arrows come from the "cause block" and enter the "effect block". For example: receipt of proceeds from ordinary activities (reason) leads to the formation of incomes taken into account when determining the taxable base (consequence) - Figure 4.

Rice. 4

The final "cause blocks" are deciphered by a report, which reflects those transactions for which the indicators "BU", "OU", "PR" and "BP" were formed. In this case, by the checkbox Expand by documents account entries can be detailed down to the level of documents by which they are formed.

Most often, the source of errors is "manual" operations, when entering which the accountant either forgets to reflect the business transaction in tax accounting, or reflects it incorrectly. To correct such errors, it is necessary to find the line with the document details in the report for the final "reason block" Operation (accounting and tax accounting), click to go to this document and fill in the bookmark correctly Tax accounting and then re-generate the report and make sure that the error has been fixed.

Report "Analysis of the state of tax accounting for VAT"

To check the correctness of the data that will be used by the program for filling Log of received and issued invoices, Shopping books, Sales books and VAT declarations report intended Analysis of the state of tax accounting for value added tax(fig. 5).

Rice. five

The report is in the menu Reports -> Analysis of the state of VAT tax accounting.

The report consists of a general scheme of the tax base and explanations of individual blocks of this scheme. The report shows the amount of VAT charges and deductions by type of business transactions.

On the left is a group of blocks reflecting the accrued VAT to be included in Sales book, on the right - VAT accepted for deduction and to be included in Shopping book.

Each block reflecting the accrual or deduction of VAT contains two indicators:

- the amount of calculated VAT (yellow background) - the amount of VAT that was actually included in Shopping (sales) book;

- the amount of uncalculated VAT (gray background) - VAT, which, according to the system, could potentially fall into Shopping (sales) book, but was not included in them.

If the block contains entries with errors, then a red exclamation mark is displayed next to it.

When working with a report, you should first analyze the decryption of those blocks next to which there is an exclamation mark indicating an error.

In addition, you should get a decryption of those report blocks for which there is an amount of "uncalculated VAT" - check the validity of the fact that the amount of value added tax was not included in Shopping book or Sales book in the current tax period.

Let us analyze the procedure for analyzing the transcripts using the example of the "Acquired values" and "Offset of advances issued" blocks.

An explanation of the “Acquired Values” block is shown in Figure 6.

Rice. 6

You should check the group of lines "Not reflected in the purchase book", which is a decoding of the amount "VAT not calculated", which is presented in the main menu of the report for this block.

At the same time, the program will highlight groups of reasons why the VAT presented did not fall into Shopping book:

1. VAT is included in the price.

The inclusion of VAT in the cost in the receipt documents may be associated, for example, with the fact that the organization carries out activities that are not subject to VAT, and for those values that are used in this activity, it includes VAT in the cost immediately at the time of receipt.

2. The checkbox is not checked Include VAT.

Upon receipt of goods, works and services without VAT, the flag Include VAT can be removed by the user - this action is quite correct, for example, if the state duty for registration of property rights is reflected in the system.

3. There is no invoice received.

In most cases, the warning about the “Missing invoice received” error is due to the fact that the supplier (contractor) did not provide the invoice or was forgotten to enter into the system.

If it is not possible to find and enter information about the invoice into the system, then you need to write off VAT to account 91. To do this, you can use the document VAT write-off.

Consider the block Recovery from advances issued(fig. 7).

Rice. 7

You should check the group of lines "Not reflected in the sales book", which is a decoding of the amount "VAT not calculated", which is presented in the main menu of the report for this block.

The program will highlight groups of reasons why VAT was not included in Sales book:

1. The accrual is not reflected in Sales book.

An error associated in most cases with errors made by the user. VAT on advances, which, after the receipt of values, is subject to reflection in Sales book, was not included in the document Formation of records of the sales ledger.

2. Paid values were not received.

Information on the amounts of VAT on advances issued that can be included in Sales book after the receipt of values, for the delivery of which these advances were issued.

All reviewed reports make it much easier to check the correctness of accounting data, tax accounting for income tax and tax accounting for VAT, in anticipation of the formation of regulated reporting. The reports allow you to identify situations that took place in the accounting and which look like errors. It should be remembered that specific situations are possible that rarely occur and therefore are not taken into account by the developers of these reports. Therefore, a careful analysis of the errors reported by the reviewed reports should be carried out.

Now I will show you how to find the cause of a common error in the cash book of 1C: Accounting, namely the error " Turnovers for documents and transactions do not match". This error occurs often, but it is very easy to fix. Let's see first what this error means in the 1C cash book.

Cause of the error "Turnovers for documents and transactions do not match"

Actually, the 1C Cash Book has at least two reasons for this error. One of them is not very common and I will point out it later. Now let's see the most common reason.

Generally speaking, 1C often gives such errors that it is far from always possible to determine from their text what exactly the program is asking to fix. Especially often such difficulties are encountered by beginners who do not have any significant experience in accounting in the 1C program. There are many similar "muddy" mistakes at the end of the month. But the error of the cash book indicated in the title is not at all complex.

As you can see from the text of the error, 1C does not like that the turnover amounts for the accounting register entries and posted documents differ. The difference can be a million rubles or just one kopeck - there is no difference. Since we are talking about a cash book, then under "documents" we mean incoming and outgoing cash orders. As for the postings, all postings on account 50 are taken into account here, which can be not only in PKO and RKO, which many forget or do not know at all... Also, do not forget that the cash book, when displaying an error, also indicates the date on which a discrepancy in the turnover of transactions and documents was detected.

Considering all of the above, we can conclude that 1C analyzes the presence of postings on account 50 and looks for PKO and PKO corresponding to these postings. And if, for example, there are postings, but there is no document, then an error about the mismatch of revolutions is issued. It is also possible that there is a posting and a document, but the amounts in them do not match. The cash book starts to swear, and the user safely goes online ...

There was an important part of the article, but without JavaScript it is not visible!

All this - the most common reason errors in the formation of the cash book. However, there is also a second reason. An error similar to the text is shown if 1C detects that on some days the amount of the cash balance turned out to be less than zero. The situation is, frankly, unlikely. However, given that 1C Accounting admits conducting expense transactions, as a result of which the cash balance may become negative, such a possibility should not be ruled out.

The given second reason for the issuance of an error by the cash book is not found in all versions of 1C. You can easily check if it is in your version - create a cash settlement with an amount exceeding the cash balance, and then create a cash book. If 1C does not swear, then it does not react to it.

How to fix this error in the cash book

I will not comment on the negative cash balance here, because everything is clear here. Let's tackle reason number 1.

To correct the error in the mismatch of turnovers, you need to find on the date indicated by the cash book all documents with postings on the 50th account and see if these postings correspond to PKO / Cash register; also check that the amounts in transactions and PKO / PKO are correct and match. If the error is displayed for several dates, then check everything.

Let me give you an example. Let's say you have completed a Retail Sales Report. By itself, this document ALREADY contains a transaction on account 50. Thus, if you post a Retail Sales Report, but do not create a corresponding cash receipt order, then there will be a posting at the cash register, but there will be no document (i.e. PKO)! In this case turnovers on postings and documents just do not coincide with the amount available in the "Report ..." posting on account 50. Here is the cash book and will report this.

How to avoid accounting errors

It is worthwhile to carefully monitor that each posting at the checkout corresponds to the PKO / RKO. There is nothing complicated here.

By the way, I gave above one example of an operation in which the error "Turnovers on documents and transactions do not match" appears in the cash book. There are other cases not so obvious. So stay alert!

Consideration of cash book errors is included in the curriculum of the 1C course, which you can familiarize yourself with on the website.

How to work with the cashier correctly?

Checkout: check the balance at the checkout. Who is required to keep the cash book? In what order to start a work shift at KKT? How to comply with the cash balance limit?

Question: No one can clearly and specifically answer questions about working with an online cash register. I cannot understand how now you can check the balance at the cash register, and what amount should be in it. In the reports on the cash register, the balance, income and expense are not visible. The cash desk is actually reset to zero when it is closed and there is no money in it. We always have a balance at the checkout - a bargaining chip in the amount of 100,000 rubles, we always issue salary from the checkout. It turns out that they wanted to make a withdrawal from the cash register for an advance, but writes that there is no such amount available (the cash desk only has funds for the current day, but, of course, more is needed). Cashiers claim that now there is no concept of cash desk, there is only an online cash desk (transfer of checks to the Federal Tax Service) and nothing else. In Taxcom's personal account, you can also see only movement by day, no leftovers either at the beginning or at the end of the day, and these functions must be configured in the cash register. In this case, you do not need to keep a cash book, but you still need to keep the cash register. Some kind of mess in the cash register turns out. If earlier inspectors could withdraw cash balances and identify surplus (which was very fraught) or shortage, now there is complete uncontrollability. How to work with the cash register correctly - is it possible to take out of it every day and can it be put in a safe, and then once a month take it to the bank and, is it possible, from the amount in the safe to issue a salary, an advance payment, an account? Or you need to carry money to the bank every day .. Maybe you need to make a deposit of the entire cash balance every day, when the shift is opened, and then it will be possible to take out to the salary, etc., and when the shift closes, take out or not. In general, nothing is clear. Nobody can really say anything.

Answer:You need to keep a cash book. cash book according to the form No. KO-4. This should be done by all organizations, regardless of the applied taxation system or their organizational and legal form.

Cashbox- a subdivision of the organization that performs cash transactions. There are operating and central (main) cash desks. Operating cash desks (there may be several of them) are intended for direct settlements with clients. They carry out operations to receive (issue) cash and keep their primary records. The central (main) cash desk provides storage and consolidated accounting of cash as a whole for the organization. Information about the movement and balances of funds in the central (main) cash desk is reflected in accounting on account 50 “Cashier”.

That is, the cash register where the online cash register stands in this case will be operating. And the main cash desk, where you deposit money at the end of the shift. At the end of the shift, only the amount of the change fund can remain in the cash register, if it is issued not every day, but for a certain period (week, month).

main cash desk by order of the head.

main cash register, reflect in the form No. KO-5.

Cash registers allow you to register transactions that are not related to sales or refunds to the buyer. Therefore, to control the movement of cash in the cash drawer of the cash register, use the non-fiscal operations: "Deposit money" and "Cash out".

If the change fund is issued daily, then at the end of the shift, all the proceeds (all the money that is in the cash register) must be removed and returned to the main cash register. Make up PKO for the amount of proceeds and make entries in the cash book.

If the exchange fund is issued for a certain period, then the amount of the exchange fund can be left directly in the cash register. The proceeds are handed over to the main cash desk, which is recorded in the cash book.

Organizations can keep cash at the cash desk only within the established limit. That is, no more than a certain amount can remain at the cash desk every day. The size of this limit for the cash book

If there is more money in the cash register, then the difference must be returned to the bank. You have the right to determine on your own how often you will hand over the excess proceeds.

Cash proceeds from sales can be spent on the payment of salaries and money to the account.

Justification

How to keep a cash book (f. KO-4)

Who keeps the cash book

Who is obliged to keep a cash book

Reflect information on the movement of cash in the cash book in the form No. KO-4. This should be done by all organizations, regardless of the applied taxation system or their organizational and legal form. * Only entrepreneurs who keep records of income and expenses or physical indicators in accordance with tax legislation have the right not to fill out the cash book. All this follows from paragraphs and 4.6 of the instructions of the Bank of Russia dated March 11, 2014 No. 3210-U, as well as from paragraph 2 of the Resolution of the State Statistics Committee of Russia dated August 18, 1998 No. 88, paragraph 4 of Article 346.11 and paragraph 5 of Article 346.26 of the Tax Code of the Russian Federation.

What is the responsibility for incomplete reflection of monetary transactions in the cash book

If cash transactions are not fully reflected in the cash book, tax inspectors have the right to fine the organization. If an organization has separate subdivisions and a violation has been identified in several compartments, a fine will be issued for each subdivision (letter from the Federal Tax Service of Russia No. SA-4-20 / 16322 dated August 17, 2017).

All money received at the cashier must be capitalized. Anyone who does not do this violates cash discipline. At the same time, capitalizing money means reflecting it in the cash book. Moreover, it is in the amount that is confirmed by the cash documents. This procedure is established by clause 4.6 of the instruction of the Bank of Russia dated March 11, 2014 No. 3210-U, and the fact that violation of it is punishable is directly stated in the Code of the Russian Federation on Administrative Offenses.

When tax inspectors check whether all cash is capitalized, they check the information in the cash book with the primary documents - PKO, cash settlement, etc. If a discrepancy is found, the organization will be fined. This right of inspectors is also confirmed by the courts (see, for example, resolutions of the Federal Antimonopoly Service of the West Siberian District of April 5, 2010 No. A03-13078 / 2009, of the Volga District of January 30, 2008 No. A12-11536 / 07-C59, of the East Siberian District of 13 March 2007 No. A74-3799 / 2006-F02-1166 / 2007).

Records about the money received that are not timely entered into the cash book are also considered a violation. That is, when entries in the cash book were made not on the day when the cash arrived at the cashier (see, for example, resolutions of the Federal Antimonopoly Service of the Volga District of June 19, 2009 No. A12-20715 / 2008, of the North Caucasian District of June 9, 2009 No. A32-11915 / 2008-70 / 75-20АЖ, dated October 10, 2007 No. F08-6779 / 2007-2517А).

The chief accountant should control whether the cash book is maintained correctly. But what if he is sick or on vacation? Then the manager is responsible for this work. If they are negligent in their duties, they will also be punished for violating the procedure for keeping a cash book under the Code of Administrative Offenses of the Russian Federation.

Here are the fines for those guilty:

from 40,000 to 50,000 rubles. - for organizations;

from 4000 to 5000 rubles - for officials. That is, for entrepreneurs, chief accountant, head (when he replaces the absent chief accountant).

By the way, cashiers are not officials. And despite the fact that they are financially responsible persons, there is no administrative fine for them. This conclusion is confirmed by paragraph 14 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated October 24, 2006 No. 18. Therefore, it is so important to control the work of cashiers. After all, because of their mistakes, both the chief accountant and the organization will be punished.

How to work with a cash register

Shift start

In what order to start a work shift at KKT

Before starting work, the cashier-operator needs to issue: *

- keys to the cash register;

- keys to the cash drawer;

- the necessary consumables (receipt and control tapes, tape for a printing device, cleaning agents, etc.);

- small change and banknotes.

Before accepting payment from the buyer, generate a report on the opening of the shift. The cashier will automatically send this report to the fiscal data operator. With a positive check, the CCP will receive confirmation. After that, you can proceed to settlements with customers.

For more information on what documents need to be processed at the end of a work shift, see.

Previously, there was such an order. Currently, these requirements are met voluntarily. After the surrender of the proceeds and registration of documents, the cashier must:

- perform maintenance of the cash register;

- disconnect the cash register from the network;

- hand over the keys to the cash machine and the cash booth to the head of the organization, his deputy or the head of the section for storage against receipt.

This procedure is provided for by clause 6.3 of the letter of the Ministry of Finance of Russia dated August 30, 1993 No. 104, which are applied in the part that does not contradict the Law of May 22, 2003 No. 54-FZ.

What documents to draw up when working with cash register

Start of work shift

Before starting work, the cashier-operator from the main cash desk of the organization receives a small change and bills in the amount necessary for settlements with customers. The director or his deputies, administrators should provide the cashier with change money. The order of circulation of changeable cash (changeable fund) is approved by the order of the head.

The change money that was issued from the main cash register, reflect in the book of accounting of the funds received and issued by the cashier in the form No. KO-5. * To confirm the receipt of change coins and banknotes, the cashier-operator signs in column 4 of the book. This follows from paragraphs 4.5 and instructions of the Bank of Russia dated March 11, 2014 No. 3210-U, paragraphs 3.8, 3.8.1 of the Model Rules approved by the letter of the Ministry of Finance of Russia dated August 30, 1993 No. 104, approved.

Cash registers allow you to register transactions that are not related to sales or refunds to the buyer. Therefore, to control the movement of cash in the cash drawer of the cash register, use the non-fiscal operations: "Deposit money" and "Cash out". *

How to arrange the transfer of change coins and banknotes from the main cash register to the cash desks of separate divisions

If change coins and banknotes are transferred from the main cash desk of the organization to the cash desks of separate divisions, then when transferring money, it is necessary:

Upon receipt of change money at the cash desk of a separate division of the organization, draw up an incoming cash order in the form No. KO-1. Issue of change money from the cash desk of a separate subdivision to cashiers-tellers of the same subdivision in the general procedure.

This conclusion follows from paragraphs and 6.4 of the instructions of the Bank of Russia dated March 11, 2014 No. 3210-U, instructions approved by the Resolution of the State Statistics Committee of Russia dated August 18, 1998 No. 88.

End of work shift

At the end of the work shift, the cashier-operator forms a report on the closure of the shift on the online cash register. The cash register will automatically send this report to the fiscal data operator. Return to the senior cashier of the main cash register the amount of money received at the beginning of the shift for exchange and initial settlements with customers. Reflect such a return in the accounting book of funds received and issued by the cashier in the form No. KO-5. In confirmation of the return of this amount, the senior cashier signs in column 9.

This procedure is provided for by paragraph 6 of Article 1.2 of Law No. 54-FZ of May 22, 2003, paragraphs 4.5 of the Bank of Russia directive No. 3210-U dated March 11, 2014, instructions for filling out form No. KO-5, approved by the Resolution of the State Statistics Committee of Russia dated August 18, 1998 No. 88.

How to comply with the cash balance limit

Organizations can keep cash at the cash desk only within the established limit. That is, no more than a certain amount can remain at the cash desk every day. The size of this limit is determined by the head of the organization. And it is with this value that the balance of cash in the cash register, withdrawn from the cash book at the end of the working day, must be compared. This procedure is established by the instruction of the Bank of Russia dated March 11, 2014 No. 3210-U.

If there is more money in the cash register, then the difference must be returned to the bank. You have the right to determine on your own how often you will hand over the excess proceeds. * You need to collect cash to the bank only for those days when the cash balance at the cash desk at the end of the working day exceeds the established limit. For example, if you hand over the proceeds every five days, then this figure (5) is used in calculating the limit. It should not exceed seven working days. And if there is no bank in the village - 14 working days. But if you donate money to the bank every five days, and the limit was exceeded earlier, then you need to donate cash without waiting for this deadline. If the limit is not exceeded, you do not need to visit the bank.

Determine the cash balance limit based on the volume:

At the same time, the organization has the right to choose the most suitable method for calculating the limit on its own.

delivery of cash to the bank.

Secure the procedure for conducting cash transactions in a separate position.

Free money is kept in bank accounts. A limited amount of cash can be stored directly at the cash desk - within the limit set by the head of the organization. This procedure is established by clause 2 of the instruction of the Bank of Russia dated March 11, 2014 No. 3210-U. *

There is an exception to this rule. Small businesses have the right not to set a limit on the cash balance at the cash desk (paragraph 10, clause 2 of the Bank of Russia directive No. 3210-U dated March 11, 2014).

What can you spend cash proceeds on?

Cash proceeds from sales can be spent on: *

salary;

social payments;

payment for goods or works (except for securities);

accountability to employees, including travel;

a refund if the buyer has canceled the goods or services that he paid for in cash;

reimbursement of expenses to employees who paid for insurance in cash;

payment to a bank payment agent or subagent;

personal needs of the entrepreneur.

For these purposes, you can spend the proceeds only from the sale of your own goods, works and services. Cash received from citizens as payment to other persons, hand over in full to the bank. For example, this should be done in case of intermediary agreements, payment for the services of mobile operators or commission trade.

In addition to the fact that the servicing bank can check compliance with cash discipline from time to time (this right is granted to him by law), the head of the company is also advised to control the company's cash. Due Diligence Checkout Suppose you decided to check how your business received and spent cash in the last month. The first thing to do for this is to ask your accountant how many times, when and how much cash he received at the bank, from what other sources the cash came and what balance was in the cash register at the beginning and at the end of the month. The amounts received by the accountant at the bank can be verified by reviewing the bank statements for the previous month (as noted above, it is advisable that the accountant provides the manager with a copy of the bank statement every day). At the same time, you need to pay attention to what amounts of commission fees for cash services are debited by the bank from the company's account upon receipt of each amount. Usually, the amount of cash received and the amount of the commission are located next to the bank statement. After that, you need to ask the accountant to present you with a cash receipt for each amount received at the bank. Moreover, the tear-off spine of an incoming cash order in this case should be stored in a folder with bank documents (namely, with payment orders), since it is a document confirming the fact of debiting funds from a bank account. The receipt slip itself is a document confirming the fact that cash has been received at the company's cash desk. The seal on the incoming cash order and on the tear-off spine of the incoming cash order must match. The amounts indicated in the receipt cash order and on the tear-off spine must also be identical and match the corresponding items in the bank statement and cash book. It is recommended to check the correctness of the spelling of these amounts in words. Then you should check the receipts of funds from other sources (if any). Such sources can be: proceeds from the sale of goods, works and services in cash, return of unspent accountable amounts, cash receipts from counterparties to repay debts, etc. In all cases, you should check the correctness of the receipt of cash receipts, as well as the reflection of the corresponding amounts in the cash book. After you have finished checking the receipt of cash, you need to calculate the total amount of the receipt for the checked month, and then ask the accountant to bring you a statement or journal-order at the cash desk and verify the received amount of the receipt with the amount indicated in the statement (journal-order). Then you can start checking the spending of cash. The document confirming the issuance of cash from the cash desk of the enterprise is only an expense cash voucher. Some managers, due to lack of knowledge, mistakenly believe that cash disbursements from the cash register can be confirmed, for example, by a copy of a check from a store or a payroll for the issuance of wages. This is a delusion: these documents are confirmation of the fact of spending cash, but not issuing it from the cash desk. For the total amount, which is indicated in the payroll for wages, a separate cash outflow order is issued; in it, the accountant or cashier acts as the recipient of the money, who will pay money to the employees of the enterprise. So, ask the accountant to bring you all the cash receipts for the checked period of time. If the accountant for some reason cannot do this, know that something is wrong here. An outgoing cash order must be drawn up at the time of issuing cash from the company's cash desk. Any deviations from this rule from the point of view of the current legislation are considered as a violation of cash discipline, and for this there are rather severe sanctions that can be imposed not only on accounting employees, but also on the manager, as well as on the enterprise itself. All issue orders must be added in chronological order. First of all, you should pay attention to the date of issue of funds indicated in the order: whether it corresponds to the period being checked. Then look at who is listed as the recipient of the cash outflow order. Is this person an employee of the company? If not, check with the accountant to whom and on what basis the funds were paid under this document. The consignment note must contain the passport details of the recipient. In principle, if there is a desire and opportunity, they can be checked. If you have a good acquaintance in the internal affairs bodies, then you can ask him to clarify whether such and such a person is really the owner of such and such a passport; however, officially no one will provide you with such information. In the absence of the necessary acquaintance, you can try to independently find data about this person or his passport. The amount of funds issued under the cash outflow order must be written in numbers and in words, clearly and legibly. The amount must be written in words by the recipient of cash, then put the date of receipt of the money (by the way, pay attention to the date - day, month and year) and sign. One of the most important details of an expense cash order is the purpose of issuing cash from the company's cash desk. It is necessary to compare the recipient of the funds indicated in the document and the purpose for which the funds were issued: it is possible that you will find interesting facts. For example, a rather strange situation looks when cash for purchasing RAM for a computer is given to a loader from a warehouse, and money for buying a heavy battery for a truck is given to a charming fragile girl who works as an office manager in the sales department. In these cases, there is a discrepancy between the recipient of funds and the purpose for which these funds are issued, so you should ask the accountant in detail what caused this situation. If you have any questions about a certain cash voucher, you should invite an accountant and ask him to provide supporting documents for the specified amount. Such documents can be cashier's checks or copies of checks, payroll for the issuance of wages, an advance report of a posted employee, etc. The amount indicated in each cash outflow order must be reflected in the cash book. When reconciling orders with the cash book, you should also pay attention to the correspondence of dates. After you have checked the cash flow, you should independently calculate the total amount of the expense for the month and compare it with the one reflected in the statement or journal-order at the cash desk. Of course, these amounts must be the same; otherwise, you need to ask the accountant for a detailed explanation. At the end of the check, you need to take the amount of cash balance at the beginning of the month, add to it the amount of cash receipts for the checked month, which you calculated and checked with the accountant earlier, subtract the amount of cash spent for the month and check the result with the cash balance at the end of the checked month (the amount of the balance can be seen in the cash book, as well as in the statement or journal-order at the cash register). If the amounts agree, everything is in order. Otherwise, you should have serious complaints against the accountant. By the way, do not forget that, in principle, there can be no negative cash balance at the cash desk. It so happens that some particularly impudent accountants try to prove to the director that "in modern accounting, everything is possible, including a negative cash balance." They say that the balance is negative because such and such a counterparty did not pay on time or some employee did not report for some amounts. Remember: completely different accounts are intended for fixing outstanding debts or something similar in accounting, and only the presence (or zero balance) of cash is reflected in the cash desk. Therefore, an accountant who is trying to prove to the manager that a negative cash balance is normal should be disposed of as soon as possible.