The first use of bank cards was associated with withdrawing certain amounts from a card account and depositing cash. However, the functions of cards were gradually expanded, and devices appeared that allow you to pay for purchases in retail chains. Owners of modern bank cards appreciated the high service of non-cash payments. Managers of trade organizations began to think about what acquiring is and what advantages its use provides.

The fact is that such a simple procedure as installing a card in a POS terminal and entering a PIN code to carry out an expense transaction in any supermarket indicates only part of a functioning system for the transfer and processing of information, numerous checks and approval of payment.

Acquiring concept

Translating the word from English will help you understand what acquiring is. The literal meaning of the word is translated as “acquisition.” This term is common in the banking sector when defining the system of accepting special cards for payment. In practice, acquiring provides the opportunity to make purchases and pay for services without using cash.

The rapid replacement of “paper” money with non-cash amounts showed how in demand and convenient this function is. Modern life is no longer possible without bank plastic. You can get an idea of acquiring and what it is in simple words using the example of common non-cash transactions. Just recently, people lined up at the cash desks to pay for housing and communal services, but now it is enough to insert the plastic card into the terminal and carry out the necessary expense transactions, and upon completion of the procedure, receive a check that replaces the payment receipt.

However, like any other invention, in the early stages acquiring was quite simple and had a limited set of functions. Many entrepreneurs were just thinking about acquiring, and what it was was familiar only to the most advanced companies.

The beginning of accepting cards for payment is associated with the removal of the so-called slip, i.e. a paper slip with details. At first, the use of such a system was unsafe - the lack of communication with the bank did not allow checking whether there was a sufficient amount in the client’s account. If the purchase was expensive, the teller could call the bank to make sure that the client had the required amount. The emergence of special electronic devices that establish communication with the bank has increased security and simplified the work of making payments.

Acquiring is a bank service that provides comprehensive services to an organization for payments using payment cards. Full service includes technological, calculation and information support.

The use of an acquiring system involves work on preliminary preparation and further servicing of payments. First of all, the organization enters into an agreement with a financial structure offering acquiring services. Within the framework of this cooperation, the acquirer is a bank that owns payment terminals, which are installed in stores and other payment points (restaurants, gas stations, cafes, etc.). If it is necessary to ensure a connection between card acceptance and cash registers, PIN pads are installed at points of sale.

The plastic product issued by the bank represents the key to the payer's account. One of the signs of a competitive financial organization is the emission of plastic. Thanks to the connection to international payment systems, it has become possible to accept cards in other countries of the world if the issuer is a participant in this system. You can find out which system the customer card belongs to by the logo printed on the front side of the plastic. The most well-known payment systems in Russia are Visa and MasterCard. Recently, the use of its own payment system called “Mir” has been actively introduced.

Each organization engaged in trade or providing services, connecting to acquiring services, takes measures to install special equipment and organize its operation through payment system participants. As a result of close cooperation with acquiring banks, the process of cashless purchases in stores has become simple and safe.

Features of acquirer services

To ensure stable operation, the organization signs a special acquiring agreement. According to the provisions of the agreement, the acquiring bank installs POS terminals and provides software support.

The list of bank obligations includes:

- provision of technological equipment (free installation, rent, right of purchase);

- setting up work on accepting bank plastic for accepting payments;

- work on training cashiers to accept and service card transactions;

- provision of consumables;

- routine maintenance;

- Information support.

For its part, the organization must also fulfill its obligations to the bank.

As technology develops, the list of types of available services expands:

- trade acquiring;

- mobile;

- exchange;

- Internet acquiring.

The organization independently determines the types of acquiring it needs to develop its business.

The use of POS terminals is provided for carrying out expenditure and return transactions. As a result of payment by card, funds are sent to the seller to his account with the simultaneous deduction of the commission established under the agreement.

The service fee and possible restrictions are tied to the volume of funds in the organization’s trade turnover.

The trade variety is considered one of the most popular, providing cashless transactions in stores of any type. Terminals for accepting cards can be found in most retail stores selling food, equipment, building materials, spare parts, etc. There are no restrictions on the types of activities of the organization. Trade acquiring is successfully used by public catering enterprises (cafes, restaurants, etc.), gas stations, etc. Any newly opened or operating large network must organize the acceptance of non-cash payments, since the success of any enterprise is directly related to the provision and increase in comfort to the buyer.

The acquiring bank service is not free for the organization. Each transaction for non-cash receipt of funds entails writing off a certain percentage of the amount in favor of the financial structure (usually in the range of 1.5–2.5%).

This view is intended for mobile device users. Payment transactions are made using smartphones, eliminating the requirement to be linked to a retail outlet. In fact, it is possible to equip each employee with terminals, including those who work remotely. There is no longer any need to link the terminal to a specific cash register. Moreover, the seller or courier can deliver it to the buyer’s home and make payment on the spot.

A high degree of comfort requires additional payment for the services of the acquirer. As a result, the use of mini-terminals costs a commission of 2.5–3% of the payment amount.

The method by which payment for goods is made in favor of an online store is called Internet acquiring. Internet access is required to receive payment. There are no additional devices or applications provided.

In fact, any Internet user who has a bank card can make debit transactions, provided with a high level of protection by the intermediary structure. The intermediary company collects and sends information in both directions – to the bank and the seller.

The particular convenience of the acquiring system is due to its accessibility to almost any online trading platform that has a special interface. The buyer makes a few clicks, without leaving home, to order and pay for the goods. For payment, not only bank plastic is accepted, but also other sources of electronic payment systems.

The absence of the need for additional equipment and maintenance costs is combined with increased commissions charged by banks. As a result, an average of up to 6% is written off from the total payment amount. This is the price to pay for a high degree of protection from the actions of Internet scammers and hackers.

The directions for implementing this acquiring have practically no restrictions - any product, service, order can be paid through the network (goods, utility bills, payment of communications, fines and much more), which increases the company’s turnover.

The leading position in popularity is occupied by ATM acquiring of bank cards, familiar to every plastic card owner. There are practically no organizations left that pay wages in cash. When hiring a new employee, a card is required to be issued, to which the transfer of funds from the company will be organized in the future. In the future, the employee receives cash using ATMs installed everywhere.

To receive cash, you need to insert bank-issued plastic into the card reader and enter the security code. Working through the opening menus, the plastic holder selects the amount required for withdrawal. If there are enough funds in the client's account, the operation is completed successfully.

Please note that cards issued by different banks must be serviced in the terminals of a specific bank. Otherwise, the client will be charged a commission for the services of a third-party bank. The same applies to settlements abroad. Each cash withdrawal entails a commission deduction.

The choice of acquiring bank is of great importance, affecting the work of the entire organization. Before choosing a specific acquirer, you need to study the proposed conditions and perform a number of actions:

- Studying the equipment that the bank equips. The speed and safety of operations depends on the technical capabilities of the devices and programs used. As a rule, the bank offers the use of POS terminals, imprinters, processing centers, cash registers, and PIN pads.

- Selecting the type of connection with the bank. The speed of payment depends on it. In case of active expenditure transactions, choose faster communication options: Ethernet, Wi-Fi. In this case, the operation is completed within 3 seconds. The use of GPRS communication entails additional costs for operator services according to the established tariff.

- Selecting a payment system. Each acquirer works with a specific payment system; card service conditions may vary depending on the choice of organization.

- It is necessary to carefully study the terms of cooperation established by the agreement before signing. Particular attention is paid to the client’s responsibilities and rights. If it later turns out that any of the bank’s requirements have been violated, there is a high risk of litigation and subsequent troubles.

- When choosing a bank, pay attention to the breadth of the range of services provided and the quality of work. The main types of services provided by the acquirer are installation and maintenance of the provided equipment. Provides training on how to operate card acceptance devices.

- Tariffs for services. The payment for the service provided appears in the form of a commission. The amount of interest charged for each transaction may vary primarily depending on the turnover and volume of transactions carried out by the organization. The cost of services is also affected by the possibility of licensed operations, specialization of activities, and the presence of a processing center.

The advantages and special comfort of acquiring were appreciated by all users of banking plastic. With its help, all payments began to be made faster and more convenient. If, when paying in cash at the cash register, small change coins were required, then working with cards frees you from problems with change.

Non-cash payments have a number of undeniable advantages compared to cash transactions:

- The organization reduces the risk of receiving counterfeit bills.

- Completing a transaction through high-speed communications is faster than counting money at the checkout and searching for change.

- The need for collection services is significantly lower, which leads to cost savings for the organization.

- When issuing change in cash, the chances of making a mistake are quite high, while accepting cards eliminates the possibility of miscalculation.

- It has been established that a buyer who pays with a credit card is more willing to part with funds, and the amount of the check is larger than when purchasing with cash. Statistics show that owners of plastic are more likely to make unjustified and spontaneous purchases, while a person buying with cash limits the amount and list of goods purchased. The difference can reach one third of the average check in a store.

Despite the presence of pronounced advantages, the use of acquiring has its disadvantages, which must be taken into account when organizing work on non-cash payments:

- System instability. From time to time, like any other equipment, the terminal may fail, a server failure occurs, and as a result, customers begin to be indignant and displeased due to the inability to use the card. However, in some cases the problem can be quickly resolved by temporarily switching to cash payments (only for merchant acquiring).

- System security. Measures to improve the level of security are constantly being taken; many banking services and specialized companies are working to improve the protection of client finances. However, scammers in the field of programming are also actively working. As a result, you have to vigilantly monitor your defense. It is important to prevent hackers from using the personal data of customers and clients, as well as to block access to card details for outsiders.

- Working with cash requires less knowledge in handling technology. An untrained specialist simply will not be able to conduct transactions, slowing down the work of accepting payments from clients and customers. However, any modern trade places increased demands on staff in order to provide comfortable conditions to its customers.

It is difficult to imagine a successful commercial structure that would use only cash in circulation. Almost any buyer or potential client has a plastic product from the bank, which receives labor income, various government benefits, pensions, and transfers from private individuals. The most common use case is receiving wages on a card.

The concept of acquiring has become a part of modern life for both buyers and sellers. Non-cash payments have become the most common phenomenon when paying utility bills, fines, and duties. When deciding to make a purchase in a particular store, a person is more likely to prefer the establishment where he can quickly pay with a card. The lack of terminals for accepting cards for an entrepreneur means lost profit.

Even if the buyer decides to shop in a store where there is no cashless payment, the amount of the receipt will be significantly lower.

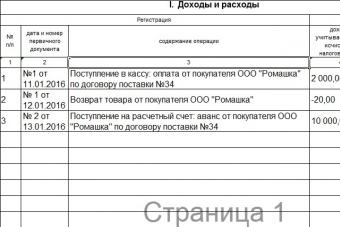

Accounting support for acquiring transactions when receiving payment by bank cards occurs in the following sequence:

- Purchase of goods, settlements with suppliers.

- Sale of goods or provision of services to individuals.

- Accepting payments by plastic cards, making payments through a special POS terminal provided under an acquiring agreement.

- Write-off of cost of goods sold, display of sales revenue.

- The actual receipt of funds into the current account through the acquiring bank after processing incoming payments from the company's clients.

Currently, most stores, medical or cosmetology clinics and various retail companies accept bank cards for payment through special POS terminals to attract more customers. The operation of accepting payment for goods and services in retail trade with plastic cards is called acquiring. Since transactions involve individuals, entries for accounting for wholesale trade are not applicable here.

The peculiarity of acquiring operations is that, in fact, payment from buyers is transferred to the company’s current account after processing all bank card payments by the acquiring bank, with which a special agreement has been concluded.

The acquiring agreement stipulates:

- Conditions for installing special equipment and its maintenance.

- Payment for the bank's work: acquiring banks charge a commission for servicing the company and processing payments in the form of a certain percentage of the amount of transactions performed. The bank's commission for making and processing incoming payments is included in the company's banking costs and is recorded on 91 accounts.

- Deadline for crediting money to the client’s account, etc.

- Payment systems available for processing by the acquiring bank. In accordance with changes in the legislation of the Russian Federation, trading companies with annual revenues of more than 40 million rubles are required to accept bank cards of the MIR payment system for payment. The exception is companies located in areas without mobile communications and the Internet.

Something to keep in mind! The terms of cooperation are formed separately for each trading company and may differ.

Although goods are sold to citizens as part of retail sales, they are not described on the basis of entries for accounting for goods at retail in sales prices. Accounting for acquiring transactions is carried out on account 57, to which a separate sub-account 57.03 is opened. It is active: debit displays customer purchases in correspondence with account 62, which takes into account settlements with the company’s customers; for a loan - the actual crediting of payments to the company's current account in correspondence with 51 accounts, the analysis of which is carried out separately for each current account.

In 1C, acquiring transactions are displayed on a separate tab in the retail sales report.

Displaying acquiring transactions in 1C

Basic accounting entries for acquiring transactions

Stages of sales in company accounting:

- Dt62R Kt90.01 - the company’s revenue is displayed.

- Dt90.03 Kt68.02 - calculation of VAT on sales.

- Dt57.03 Kt62R - display of customer payments through the terminal.

- Dt50.01 Kt62R - receiving payment in cash.

- Dt51 Kt57.03 - crediting customer payments through the acquiring bank on the next business day (depending on the bank, there may be delays of up to 3-5 days).

- Dt91.2 Kt51 - bank commission.

When carrying out retail trade, you do not need to use account 62:

- Dt57 Kt90.01 - company revenue.

- Dt90.03 Kt68.2 - calculation of VAT on sales payable.

- Dt51 Kt57 - actual crediting of funds towards non-cash payment from buyers (in the bank statement the payer will be the acquiring bank).

- Dt91.2 Kt51 - withholding a percentage of the acquiring bank for payment processing.

Something to keep in mind! Retail trade refers to the sale of goods or services to the final consumer; assets are not intended for further resale.

Case Study

Example 1

The Klaviatura store carries out retail trade and accepts bank cards for payment. According to the acquiring agreement with the bank, the commission for making payments is 2.4%. During the day, the company sold goods worth 50,766 rubles. 00 kop. (excluding VAT), and all sales were made using plastic cards through a POS terminal.

Accounting entries in store accounting:

- Dt57.03 Kt90.01: 50,766 rubles - the revenue of the “Keyboard” store is displayed;

- Dt51 Kt57.03: 49,547.62 rub. - payment from buyers has been credited to the bank account;

- Dt91.02 Kt57.03: 1,218.38 rub.

Acquiring: postings in accounting

Bank interest is taken into account.

Example 2

Limited Liability Company "Jupiter" provides cosmetic procedures, payment for which is accepted in cash or by bank card. The agreement with the acquiring bank provides for 3% of the amount of payments for processing and servicing. During the day, the company made sales of services for a total amount of 98 thousand rubles (including VAT 18% - 14,949.15 rubles), of which 3 sales for a total amount of 28 thousand rubles were made through the card terminal.

The accountant generated the following entries:

- Dt62 Kt90.01: 83,050.85 rub. - displays the company's revenue;

- Dt90.03 Kt68.02: 14,949.15 rub. - VAT has been calculated and must be paid to the tax authorities;

- Dt57.03 Kt62: 28 thousand rubles. - part of the payments for procedures were made by payment cards;

- Dt50.01 Kt62: 70 thousand rubles - receipt of cash payment for services rendered to individuals;

- Dt51 Kt57.03: 27,160 rub. - non-cash payments by customers with cards are credited to the bank account from the acquiring bank;

- Dt91.02 Kt57.03: 840 rubles - bank commission is included in other expenses.

Victor Stepanov, 2018-06-19

Questions and answers on the topic

No questions have been asked about the material yet, you have the opportunity to be the first to do so

Reference materials on the topic

Question. The bank credits to our account the payment received through the terminal, minus bank expenses, in the amount of 1.8% of the payment amount. How to correctly reflect our income in accounting. Our bank is unloaded into 1C. It turns out that you need to constantly enter manual entries for the receipt of terminal funds and bank expenses? We have a terminal every day. We are on the simplified tax system (income minus expenses).

According to paragraph 1 of Art.

Accounting for acquiring transactions in "1C: Accounting 8"

346.15 of the Tax Code of the Russian Federation, taxpayers using the simplified taxation system take into account income from sales in accordance with Art. 249 of the Tax Code of the Russian Federation. Revenue from sales is revenue, which is determined on the basis of all receipts associated with payments for goods (work, services) sold.

Thus, when forming the tax base for a single tax paid in connection with the application of a simplified taxation system, the entire amount of revenue received from sales should be reflected in income.

When determining the object of taxation, the taxpayer reduces the income received by the expenses listed in paragraph 1 of Art. 346.16 Tax Code of the Russian Federation. Expenses associated with payment for services provided by credit institutions are taken into account when calculating the tax base for the single tax on the basis of clause 9, clause 1 of Art. 346.16 Tax Code of the Russian Federation.

Thus, when revenue received through the terminal is credited to the current account, the following entries should be made in accounting:

Debit 76, subaccount “Settlements with the bank” Credit 90 – for the amount of revenue deposited through the terminal;

If analytical accounting of settlements with buyers (clients, consumers) is organized on accounting accounts, then the following entries are made:

1) Debit 62 (by counterparties) Credit 90 – accrued debt of buyers (clients, consumers);

2) upon receipt of funds to the current account:

Debit 51 Credit 76, subaccount “Settlements with the bank” - for the amount of funds credited to the current account;

Debit 76, subaccount “Settlements with the bank” Credit 62 (by counterparties) – for the amount of revenue deposited through the terminal;

Debit 91-2 Credit 76 “Settlements with the bank” - bank commission.

Payment through the terminal for utilities and other types of services

Today, making payments through terminal systems is very convenient and, although not like the Internet, practical - payment is made without commission, it is possible to pay for many different services, and the speed of the transfer can only please you. The instructions for paying utility bills through the Sberbank terminal and paying for other services will tell you about the rules for making a number of payments.

Through terminal payment systems you can make payments for housing and communal services, loan repayments, state fees, Internet payments, taxes, and patents.

The procedure for paying through a Sberbank terminal is largely similar.

This means that the data is generalized - you do not need to look for information that contains, for example, instructions for paying for electricity through a Sberbank of Russia terminal.

However, many people, despite the popularity of online payment methods, continue to use a more traditional method - terminals.

Payment for housing and communal services

In order to pay through terminals for these services, you need (if you don’t have cash) a Sberbank plastic card. If you don’t have it, you can issue a Maestro Momentum card for free.

Here are step-by-step instructions for paying for housing and communal services through the Sberbank terminal:

- Find the nearest Sberbank ATM and enter your card.

- A PIN code entry field appears on the screen - enter your PIN code.

- Next, click on the “Next” text that appears.

- Main menu, you need to select here the column called “Payment for services”.

- Click on "Utility Payments".

- In order for the receipt to be paid through the Sberbank terminal (after a special field appears), you need to enter the number from the EPD, which is designated as “Payer Code”.

- Click “Next”.

- We re-enter the code from the receipt, and enter the date in the required field.

- Select the amount and click “Pay”.

- The payment is completed, you need to log out of the system - click the “No” button, and then wait for the device to issue a receipt.

Note: You should never throw away a check, as it will be required in cases where payment of housing and communal services receipts through the Sberbank terminal was not completed successfully, or any difficulties or problems arose.

It is the receipt that will serve as your evidence - this is confirmation of the transaction you performed through this ATM.

The instructions for paying in cash through the terminal are absolutely the same, but you need to remember the nuance mentioned above.

Loan repayment

Now about how to pay a loan through a Sberbank terminal using a bank card:

- Based on the first three points above, get to the main menu.

- Select "Loan repayment".

- In the field that appears, you must enter the necessary details - 20-digit account.

- Next, enter the date.

- Just like in the previous case, we wait for the terminal to issue a check.

Note: Make sure the information about the debtor and the amount are correct. It is even possible to repay loans from other financial systems, but then there will be a commission of 1-1.5%.

Payment of state duty

Payment of the duty through the Sberbank terminal is carried out as follows:

- You need to have information about the payer’s TIN, as well as OKATO of the organization receiving the cash savings.

- Also remember that you will need to enter the payer’s passport details.

- In the main menu, select the desired item.

- We fill in all the required fields (in accordance with the information in the documentation).

- We log out and wait for the check.

In this case, the instructions for payment through the Sberbank terminal also provide that you can familiarize yourself with the amounts of state duties with the help of a legal organization associated with the processes of imposing certain duties, or according to the law.

Internet fee

If you need to pay for the Internet through a Sberbank terminal with a card, then you need to do the following:

- Insert the card into the ATM, then enter the code.

- Select the “Payments in your region” operation.

- From all the items, select the one that indicates the payment function for communications and Networks.

- Use the arrows located in the right corner of the screen to select your specific service provider.

- Next, you will need to enter the numbers of the personal account that you use when paying with this organization. Note: instructions for paying by card via terminal in this case require prior familiarization with the prices of the communication service provider.

- In the field that appears, enter the required payment amount.

- A window will appear on the screen with all the information about this payment, make sure they are correct;

- Click "Pay".

- Pick up the check and log out.

In this scenario, bills are paid through the Sberbank terminal for services of a similar nature. You can use a Yandex Money card for payment.

Paying taxes

To complete this task, you also need to follow the points contained in the instructions for paying taxes through the Sberbank terminal:

- Inserting the card into the ATM and entering the PIN code.

- In the terminal menu, select “Payments”.

- Next, you need to click on the required type of payment - “Tax”.

- Specify the required Federal Tax Service.

Note: The Federal Tax Service is the same organization (in this case the recipient) to which funds from the payer are transferred.

An identifier (this involves paying payments through a Sberbank of Russia terminal) of 15 digits, most often it is located in a document about the need to make a payment of a certain amount.

In addition, such an identifier can be read automatically - you need to bring a special code to the device.

After verifying the data, pay for the procedure and wait to receive the check.

Thus, payments are made through the Sberbank terminal quite quickly, without unnecessary hassles or waiting in a long line at the cash desk of people wanting to make payments.

We reflect acquiring in accounting entries

This procedure does not require such measures as registering a payment terminal during operation.

Making a payment for a patent

Instructions for paying for a patent through a Sberbank terminal:

- After logging in (again in the main menu), select the option that provides for payment of other payments in your region.

- Function for paying taxes, duties and fines.

- Next we go to the Federal Tax Service (Federal Tax Service).

- "Payment for patents."

- Enter all the data necessary in this case - telephone number, Federal Tax Service number, which is used to pay the receipt through the Sberbank terminal, OKTMO code, etc.

- Find the item (at the very bottom) that is needed to refuse further provision of documents;

- Enter the required amount.

- The change will be sent to the mobile phone you specified earlier.

Transferring funds to a card

Now let's look at how to pay on a Sberbank card through a terminal - that is, make a transfer (in cash) of funds to your account. You need to do the following:

- Select the item labeled “Payments and Transfers”.

- Enter the card number that will accept funds. Note: payment to a Sberbank card through the terminal also allows you to transfer money to other accounts.

- Place the required number of bills into the bill acceptor.

- Confirm the transfer by clicking on the appropriate function.

Knowing how to pay on a Sberbank card through a terminal in cash, you can easily top up your account.

Read how to use Qiwi terminals here. Many terminals accept payment not only in cash, but also by payment cards. What cards can be used, see here.

Problem solving

How to restore a payment receipt through a Sberbank terminal if it is lost? Very simple! It is enough just to contact the senior operator of Sberbank, who is obliged to restore all the necessary documents.

You should also contact us if the Sberbank terminal took cash and the payment did not go through - employees usually try to consider all requests from dissatisfied customers.

This step-by-step payment instructions: how to pay through a Sberbank terminal will help you if you need to pay for services of a different nature. Payment through other terminals is carried out in a similar way and has only minor distinctive features, which will be discussed in this section.

"Simplified" payments via terminals

Firms and entrepreneurs using the simplified taxation system recognize income received on a cash basis. This means that the tax base increases at the moment when the money “fell” into the current account or cash register. What is the right thing to do if customers pay via the Internet or terminals?

Nowadays, settlements using electronic payment systems (hereinafter referred to as EPS), for example WebMoney, E-port, PayCash, Yandex-Money, etc., are common. This allows individual entrepreneurs and companies to conduct retail trade through electronic stores and make purchases on the Internet themselves.

Chapter 26.2 of the Tax Code does not prohibit taxpayers who apply the simplified tax system in relation to business activities in the retail trade sector from using EPS when making payments to customers. The main thing in this case is not to confuse anything when reflecting revenue. And here questions arise. Does such an entrepreneur have the right to accept advance payment from individuals and legal entities for goods sold through EPS? What documents does he need to confirm that he has received funds? Can he, in addition to a current account, use a bank card (personal account of an individual) to receive money to pay for goods?

Answers to these questions were recently given by specialists from the Finance Ministry (Letter of the Ministry of Finance of Russia dated June 5, 2013 N 03-11-11/163).

First of all, financiers drew attention to the provisions of paragraph 1 of Art. 346.17 of the Internal Revenue Code. According to this norm, when applying the simplified tax system, income is determined using the cash method. That is, the date of receipt of income is the day of receipt of money in bank accounts and cash registers, receipt of other property or property rights, repayment of debt (payment) to the taxpayer in another way.

It is necessary to take into account the procedure for making electronic money transfers. It is mentioned in paragraph 10 of Art. 7 of the Law of June 27, 2011 N 161-FZ. The electronic money operator simultaneously accepts the client's order, reduces the balance of the payer's electronic money, and increases the balance of the recipient's electronic money by the amount of the transfer.

Hence the Ministry of Finance makes the following conclusion. The moment of repayment of the buyer's debt to the seller is the moment of simultaneous acceptance by the operator of the order, reducing the balance of the payer's electronic money and increasing the balance of the recipient's electronic money by the amount of the transfer. This moment is the date of recognition of income from the sale of goods. This means that the date of receipt of income is the day buyers pay for goods using electronic funds.

Acquiring transactions

By the way, this is not the first time that the Russian Ministry of Finance has spoken about this: similar explanations are given in Letter No. 03-11-11/28 dated January 24, 2013.

If a taxpayer using the simplified tax system receives funds to his current account through electronic payment systems, then before the funds are transferred to the current account, the payment system operator withholds a commission. In the case under consideration, the taxpayer is the principal.

According to clause 1.1 of Art. 346.15 of the Tax Code for tax purposes, the simplified tax system does not take into account the income specified in Art. 251 Code. It does not provide for a reduction in the principal's income by the amount of remuneration paid to the agent. This means that the principal’s income is the entire amount of revenue coming to the agent’s account, without reducing it by the amount of the commission.

In this order, both taxpayers with the taxable object “income” and taxpayers with the taxable object “income reduced by the amount of expenses” must take into account income. Moreover, the latter have the right to take into account the amount of agency fees in expenses on the basis of paragraphs. 24 clause 1 art. 346.16 of the Internal Revenue Code.

Supporting documents

When paying for goods through EPS (payment by electronic funds), the seller is registered in one of these systems as the recipient of the corresponding payment.

Therefore, the document confirming the fact of payment for the goods may be either a statement of the corresponding account from the payment system operator, or a message from such an operator.

About settlements using a personal account

On the issue of the possibility of conducting settlements related to payment for goods sold at retail using the personal account of an individual, the Finance Ministry recommends that you contact the Bank of Russia for clarification.

Note that a company can enter into an agreement with a bank on the sale of goods (work, services) using bank cards. As a rule, this agreement stipulates that the bank transfers money to the company with the deduction of a commission from the amount of transactions using bank cards, which is indicated in the electronic journal of the POS terminal.

In a situation where the bank does not provide other documents confirming the amount of the commission, it is not clear whether the organization has the right to include it in expenses.

The fact that a company can demand from the bank a commission agent's report, which should indicate the amount of the bank's commission, follows from the provisions of the Civil Code.

Thus, under a commission agreement, one party (the commission agent) undertakes, on behalf of the other party (the principal), for a fee, to carry out one or more transactions on its own behalf, but at the expense of the principal. Upon execution of the order, the commission agent is obliged to submit a report to the principal and transfer to him everything received under the commission agreement. The principal who has objections to the report must report them to the commissioner within 30 days from the date of receipt of the report, unless a different period is established by agreement of the parties. Otherwise, the report, in the absence of another agreement, is considered accepted (Articles 990, 999 of the Civil Code of the Russian Federation).

Let’s say a company applies the simplified tax system with the object of taxation “income reduced by the amount of expenses.” According to paragraphs. 24 clause 1 art. 346.16 of the Tax Code, when determining the object of taxation, it can reduce the income received for expenses in the form of payment of commissions.

However, we must not forget that according to paragraph 2 of Art. 346.16 of the Tax Code, the taxpayer of the simplified tax system accepts expenses subject to their compliance with the criteria specified in paragraph 1 of Art. 252 of the Code. Among them is the availability of documentary evidence, in particular, documents that:

- issued in accordance with the legislation of the Russian Federation;

- indirectly confirm the expenses incurred (including a report on the work performed in accordance with the contract).

It is also necessary to remember the requirement of Art. 346.17 of the Tax Code, according to which expenses of the taxpayer are recognized after they are actually paid. Payment for services is recognized as the termination of the obligation of the taxpayer - the purchaser of services to the seller, which is directly related to the provision of services. This means that the amount of commission payment to the company must be included in expenses at the time the proceeds under the contract from buyers are credited to the current account without taking into account the commission.

The company should request from the bank a commission agent’s report confirming the commission expenses, since there is a risk of additional tax paid in connection with the application of the simplified tax system during an audit by tax services if there are no documents confirming the bank’s commission.

Accounting

The obligation of simplified enterprises to keep accounting records from January 1, 2013 is enshrined in Law No. 402-FZ of December 6, 2011.

To record the movement of electronic money, account 55 “Special accounts in banks” with the corresponding sub-account “Electronic money” can be used.

The following entries can be made in accounting:

Debit 55, subaccount "Electronic money", Credit 62

- payment (prepayment) has been received from the buyer of goods (works, services) (money has been transferred to an electronic wallet);

Debit 51 Credit 55, sub-account "Electronic money",

- money was transferred from an electronic wallet to a current account;

Debit 76, subaccount "Settlements with the payment system operator", Credit 55, subaccount "Electronic money";

- the commission of the electronic payment system is withheld from the electronic wallet;

Debit 91-2 Credit 76, subaccount "Settlements with the payment system operator",

- payment system commission is written off as expenses;

Debit 62 Credit 90-1

- revenue from the sale of goods (work, services) is reflected.

Message to the Federal Tax Service

Organizations and entrepreneurs, in addition to reporting to the inspectorate about the opening or closing of bank accounts, must inform the tax authority about the emergence or termination of the right to use corporate electronic means of payment for electronic money transfers (clause 1.1, clause 2, article 23 of the Tax Code of the Russian Federation). Such information must be submitted to the Federal Tax Service within seven days from the date of emergence (termination) of this right. The Federal Tax Service of Russia recalled this obligation in its Information Notice dated July 13, 2011.

A separate article establishing liability for violation of this obligation has not been introduced into the Tax Code. For failure to comply with the deadline provided for reporting the opening or closing of accounts, a fine of 5,000 rubles will be charged. (Clause 1, Clause 2, Article 23, Article 78 of the Tax Code of the Russian Federation).

Thus, for violation of the deadline for transmitting to the inspection the information specified in paragraphs. 1.1 clause 2 art. 23 of the Tax Code, a taxpayer may be held liable:

- or according to Art. 126 “Failure to provide the tax authority with information necessary for tax control” of the Code;

- or according to Art. 129.1 “Illegal failure to report information to the tax authority” of the Code.

Forms and formats of messages provided for in paragraphs 2 and 3 of Art. 23 of the Tax Code, the procedure for filling them out, as well as submitting messages in electronic form via telecommunication channels, was approved by Order of the Federal Tax Service of Russia dated June 9, 2011 N ММВ-7-6/362@.

I.N.Novikov

Tax consultant

Stores or service providers that accept customers' plastic cards for payment must correctly reflect revenue in tax and accounting records. In addition, they need to process cash documents - for example, when returning money to a client. This article provides detailed recommendations for those who are already using this method of calculation, and for those who are just planning to implement it.

How do payments occur using cards?

Recently, suppliers of goods and services are increasingly providing customers with the opportunity to pay using plastic cards. This type of mutual settlement is called acquiring.

When acquiring, the supplier enters into an agreement with the bank, and the bank installs an electronic device (POS terminal) in the office or store that allows you to read information from the client’s cash card. In addition, the bank opens an account for the supplier into which the proceeds will be received. At the time of payment, the required amount is debited from the client’s card, and after some time (usually a day or two) is credited to the seller’s bank account.

If trade is carried out via the Internet, buyers most often pay directly on the supplier’s website without using a POS terminal. In this case, the client fills out a special secure payment form and indicates information about his card in it. After this, the money is debited from the card and credited to the supplier’s account. This payment method is conventionally called Internet acquiring.

For acquiring services (including Internet acquiring), the bank charges the supplier a fee in the form of a percentage of the payment amount. The percentage is withheld immediately at the time of payment, and the proceeds go to the seller’s account minus the interest.

Use of cash register systems in acquiring

Sellers who accept bank cards for payment are required to use online cash registers. Indeed, according to paragraph 1 of Article of the Federal Law of May 22, 2003 No. 54-FZ, cash register equipment is used in calculations. Payments, among other things, mean the receipt and issuance of money in a non-cash manner (Article Law No. 54-FZ). And using a payment card is a type of non-cash payment. Thus, when acquiring, it is necessary to punch out cash receipts and transfer information to the fiscal data operator (FDO).

An important detail: if the client pays using a card, the seller is obliged to issue him not one, but two checks. The first is a regular cashier's check, which looks exactly the same as if the buyer paid cash. The second is a cash terminal receipt (slip). It must indicate all the necessary details, in particular, the electronic terminal identifier, date, amount, currency of the transaction, etc. The slip also requires the cashier's signature. The client's signature is required only if he does not enter the PIN code of his card (clause 3.3 of the Central Bank Regulations *).

Revenue from acquiring in tax and accounting

In accounting, income in the form of revenue received through plastic cards is generated on the day the client pays for the product or service. Until the money debited from the client’s card reaches the supplier’s bank account, it should be reflected in account 57 “Transfers in transit.” After being credited to the bank account, they must be written off as a debit to account 51 “Current accounts”.

In tax accounting, the moment of income generation depends on the supplier’s taxation system. Under the basic accrual system, income in the form of acquiring revenue is generated on the day the funds are debited from the client’s card. With the cash method and the simplified method, it is permissible to show income at the moment when the money arrives in the bank account. This was confirmed by the Russian Ministry of Finance in a letter (see “”).

Please note: despite the fact that the proceeds are credited to the current account minus the interest withheld by the bank, income must be generated for the full amount of the proceeds. Companies and entrepreneurs using the simplified tax system must show in the book of income and expenses exactly the full revenue, that is, not reduced by the bank interest.

Further, those who apply OSNO can include the bank's interest in expenses on the basis of subparagraph 25 of paragraph 1 of Article of the Tax Code of the Russian Federation. Taxpayers using a simplified system with the object “income minus expenses” also have the right to recognize expenses on the basis of subparagraph 9 of paragraph 1 of Article of the Tax Code of the Russian Federation. If the object of taxation of the “simplified person” is income, then it will not be possible to write off bank interest (letter from the Ministry of Finance of Russia dated; see “”).

In accounting, fees for bank services are classified as other costs on the basis of clause 11 “Organization expenses”.

Example

The trading company is on the basic taxation system and uses the accrual method. An acquiring agreement has been concluded with the bank, the cost of services is 2 percent of the amount received using clients’ plastic cards. On March 31, customers paid for goods using cards through a POS terminal, the amount of revenue was 10,000,000 rubles. On April 1, this amount, minus the interest withheld by the bank, was credited to the company’s account. In the bank statement, the percentage is shown as a separate line.

DEBIT 62 CREDIT 90- 10,000,000 rub. — sales revenue is reflected;

DEBIT 57 CREDIT 62- 10,000,000 rub. — payment has been received through the terminal. Tax accounting generated income in the amount of 10,000,000 rubles.

DEBIT 91 CREDIT 57- 200,000 rubles (10,000,000 rubles x 2%) - the cost of bank services is withheld;

DEBIT 51 CREDIT 57- 9,800,000 rubles (10,000,000 - 200,000) - money is credited to a bank account. Expenses in the amount of 200,000 rubles are generated in tax accounting.

Refund of money received via payment card

If a client, for one reason or another, refuses a product or service paid for with a plastic card, the seller is obliged to return the money to him. In this case, the refund must be made to the card; funds cannot be returned in cash from the cash register.

When transferring money for returned goods, the seller must issue a cash receipt with the calculation sign “return of receipt”. This check must be issued on the cash register of the organization or individual entrepreneur who accepted the money from the buyer when selling the goods. The Russian Ministry of Finance recalled this in a letter dated (see “”).

In accounting, when returning money to a customer’s card, they most often use a reversal of transactions created at the time of purchase. Simply put, the cancellation of revenue is shown in two transactions. The first is for the debit of account 90 and the credit of account 62, the second is for the debit of account 62 and the credit of account 57. Then, after debiting money from the supplier’s bank account, a posting is made to the debit of account 57 and the credit of account 51.

An acquiring agreement is drawn up between the acquiring bank and the enterprise. Under an acquiring agreement, the bank allows the company to accept payments from customers using plastic cards.

The acquiring bank provides the organization with equipment to accept payments under the agreement. These are POS terminals that allow you to read information from plastic bank cards and transfer it to the bank. The conditions under which the bank transfers equipment to the client are determined in the contract. Equipment can be provided free of charge or on a rental basis.

The peculiarity of payment by bank (payment) cards is that the funds for the transaction are received by the organization from the acquiring bank, and not from the buyer. In this case, the moment of actual receipt of money differs from the moment of payment by the buyer. Thus, at the time of such payment, the debt is transferred from the buyer to the acquiring bank.

Accounting for acquiring transactions in 1C 8.3

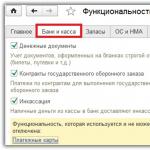

Step 1. Setting up acquiring in 1C 8.3

To reflect payments by bank cards in the 1C Accounting 8.3 program, you need to make the following settings: Main menu – Settings – Functionality:

Let's go to the bookmark Bank and cash desk. Check the box Payment cards. This setting will make it possible to carry out payments in 1C 8.3 for services and goods using bank loans and bank (payment) cards:

Step 2. How to reflect acquiring in 1C 8.3

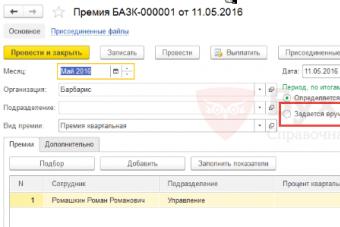

After the settings have been completed in 1C 8.3, it becomes possible to make payments to customers using the document Payment by payment card:

- With type of operation Payment from the buyer – to process payment from a representative of a wholesale buyer;

- Or with the type of operation Retail revenue – for a summary reflection of revenue at a manual point of sale:

Props Type of payment filled in from the directory Payment types, where the directory element contains information for filling out the acquiring agreement, settlement account and acquirer in 1C 8.3:

Postings for acquiring a retail document Payment by payment card with the type of operation Payment from buyer:

When reflecting acquiring transactions in 1C 8.3 retail trade in the document Payment by payment card you need to select the type of operation Retail revenue for a manual point of sale. In this case, the movement of the document will be as follows:

Step 3. Accounting for acquiring in 1C 8.3 for retail trade

Retail trade transactions with payment by payment card through a terminal for automated retail outlets are registered with a document on the bookmark Cashless payments when choosing a payment type under an acquiring agreement:

Wiring is being generated. The movement of the document will be reflected in the accounts:

Step 4. How to carry out acquiring in 1C 8.3

The acquiring bank repays the debt to the seller by transferring funds to his current account. When creating a document Bank statements – Receipts to current account necessary:

- Select document operation type Receipts from sales via payment cards and bank loans;

- In field Payer select the bank with which the acquiring agreement is concluded;

- The amount of the bank commission is filled in automatically based on the completed reference details Type of payment:

After which, in 1C 8.3, the debt of the acquiring bank is closed and a transaction is generated for the bank’s acquiring services. The movement on the document will be as follows:

Please rate this article:

This article discusses issues related to the regulatory regulation of acquiring operations, as well as their accounting and tax accounting and documentation.

Transactions related to payment with plastic cards have become everyday, as it is a convenient and safe tool. Acquiring allows you to accept plastic cards from leading international payment systems as payment for goods and services. Therefore, more and more trade organizations are using this form of payment.

The advantages of acquiring operations are:

- minimizing risks for transactions involving cash (revenue from plastic cards is difficult to steal, and they will not give you counterfeit money);

- increasing the competitiveness of the organization and increasing turnover by attracting new clients - plastic card holders;

- Transactions with plastic cards are not subject to the cash payment limit.

Terminology

A modern accountant is faced with the task of competently processing both traditional cash transactions and transactions related to payments using plastic cards. However, in order to talk about acquiring, you must first understand the specific terms inherent in this operation. Let's look at the most important of them.

Reference

Acquiring– activities of a credit institution, including settlements with trade (service) enterprises for transactions carried out using bank cards.

Payment card(bank) – a plastic card linked to one or more current (personal) bank accounts. Used to pay for goods (work, services), including via the Internet, as well as to withdraw cash.

Under electronic payment system refers to a set of specialized software that ensures transactions (transfers) of funds from a consumer to a supplier of goods, where the seller has his own account (the most common types of payment systems: Visa and MasterCard).

Acquiring bank– a credit organization that carries out settlements with trading organizations for transactions made using payment cards and (or) issues cash to payment card holders who are not clients of the specified credit organization. An acquiring bank is necessary to carry out financial transactions by interacting with payment systems.

POS terminal is an electronic software and hardware device for accepting payments by plastic cards; it can accept cards with a chip module, magnetic stripe and contactless cards, as well as other devices with a contactless interface. Also, a POS terminal often means the entire software and hardware complex that is installed at the cashier’s workplace.

Today, many banks provide a similar service; you just need to choose the bank whose conditions are favorable. The bank will charge a commission for its service, and each bank has a different percentage. The bank provides all necessary equipment and trains employees.

When using the acquiring service, you must have a current account with a bank. Many individual entrepreneurs do not have a current account - in this case, you should choose a suitable bank in which you need to open a current account and enter into an acquiring agreement. A simple definition of the principle of operation using acquiring - through special equipment, the organization withdraws the amount for the purchase from the buyer’s plastic card, and then the acquiring bank transfers it to the organization’s current account, deducting a commission from the amount for its service.

What should you pay attention to in regulatory documents?

Currently, the transfer of funds is regulated by Federal Law dated June 27, 2011 No. 161-FZ “On the National Payment System”. The transfer of funds is carried out within no more than three working days starting from the day the funds are written off from the payer’s bank account (Clause 5 of Article 5 of Law No. 161-FZ).

If funds arrive in the organization’s current account for more than one day, then in accounting, to control the movement of money, account 57 “Transfers in transit” (subaccount 57-3 “Sales by payment cards”) is used in accordance with the Instructions for using the accounting chart of accounts accounting (approved by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n). Settlements with the acquiring bank can also be accounted for on account 76 “Settlements with various debtors and creditors.”

Revenue from the sale of goods is income from ordinary activities of a trading organization and is recognized on the date of transfer of goods to the buyer, regardless of the date and procedure for payment for the goods (clause 5, clause 6 of PBU 9/99 “Organizational Income”). The actual cost of goods sold is recognized as expenses for ordinary activities and is debited from account 41 “Goods” to the debit of account 90 sub-account “Cost of sales” (clauses 5, 7, 9, 10 PBU 10/99 “Organization expenses” (hereinafter referred to as PBU 10 /99)).

It is important to know

A cash receipt order for the amount of proceeds by bank transfer is not issued.

Expenses for paying for the services of an acquiring bank that carries out settlements on transactions using payment cards are taken into account as part of other expenses and are reflected in account 91 sub-account “Other expenses” on the date of crediting the proceeds to the organization’s current account (clause 11, 14.1 of PBU 10/99 ). The proceeds from the sale of goods using bank cards are credited to the organization's current account, as a rule, minus the bank's remuneration.

Retail trade organizations have the right to account for goods purchased and sold by them at the cost of their acquisition or at sales prices with separate consideration of markups (discounts) (clause 13 of PBU 5/01 “Accounting for inventories”).

The selected options for accounting for goods must be fixed in the accounting policy.

Accounting

First, let’s establish the sequence of performing acquiring operations:

- the cashier activates the buyer’s card using the terminal, information about the card is instantly transmitted to the processing center;

- after checking the current account balance, a slip is printed in duplicate, in which both the buyer and the seller must sign;

- a copy of the slip signed by the seller is given to the buyer. The second copy (with the buyer’s signature) remains with the seller. The seller must check the sample signature presented on the card with the signature on the slip;

- The seller is obliged to use a cash register for such transactions and issue a cash receipt to the buyer.

Payments made by payment cards are entered into a separate section of the cash register and are reflected separately in the Z-report as the amount of non-cash revenue. At the same time, in the cash register, the form in column 12 reflects the number of plastic cards used to make payments, and in column 13 the amount received when paying with these cards is indicated. Information from the cashier's journal about the amount of revenue received both in cash and through plastic cards is transferred to the cashier-operator's certificate report (form No. KM-6).

note

The acquiring bank's services for conducting settlements are not subject to VAT (subclause 3, clause 3, article 149 of the Tax Code of the Russian Federation). Consequently, the cost of bank services does not include “input” VAT.

The scheme for documenting acquiring operations looks like this:

- At the end of the working day, acquiring obliges the organization to report to the bank for each transaction carried out using plastic cards. For this purpose, an electronic journal generated by the POS terminal is sent to the bank;

- the bank verifies the documents submitted to it;

- the bank transfers funds paid by payment cards to the trading company.

An acquiring agreement, as a rule, implies that the bank transfers the funds due to it to the organization’s current account, minus its remuneration.

However, the organization acts as a seller and is obliged to reflect the revenue in full, including the agreed remuneration to the bank. In this case, the bank commission in both accounting and tax accounting is reflected as “other expenses” using account 91 “Other expenses”. Organizations using the simplified tax system (with the object of taxation being income reduced by the amount of expenses) can also include bank services in expenses.

There are two main options for recording such transactions in accounting:

- the transfer of funds is carried out by the bank on the day of payment by plastic cards (see example 1);

- The transfer of funds by the bank does not occur on the day the card payment is made (see example 2).

Example 1

On September 13, 2014, using bank cards through the electronic payment system, Ritm LLC received payment from customers for goods in the amount of 46,830 rubles (including 18% VAT - 7,143.56 rubles). An acquiring agreement has been concluded with the servicing bank, on the basis of which the amount of proceeds for the goods sold is transferred to the organization's current account, minus remuneration. The remuneration amount is 1.2 percent of the amount of revenue received. The transfer of funds is carried out by the bank on the day of payment by plastic cards.

The following entries will be made in the accounting LLC "Rhythm":

DEBIT 62 CREDIT 90 subaccount “Revenue”

– 46,830 rub. – revenue from the provision of services using plastic cards in payments is reflected;

DEBIT 90 subaccount “VAT” CREDIT 68

– 7143.56 rub. (RUB 46,830 x 18/118) – VAT is charged on the amount of revenue using plastic cards in payments;

DEBIT 51 CREDIT 62

– 46,830 rub. – funds debited from customer accounts are credited to the current account;

DEBIT 91 subaccount “Other expenses” CREDIT 51

– 561.96 rub. (RUB 46,830 x 1.2%) – expenses for paying commissions to the bank are recognized.

Example

For September 14, 2014, the revenue of Trio LLC amounted to 64,900 rubles, including 47,200 rubles using plastic cards. The agreement with the bank stipulates that funds are transferred to the organization’s current account the next day after receiving the electronic journal (POS terminal is installed), the bank’s commission is two percent of the amount paid by plastic card. The bank transfers funds the next day after payment by card.

The following entries will be made in the accounting LLC "Trio":

DEBIT 62 CREDIT 90 subaccount “Revenue”

– 47,200 rub. – revenue from the provision of services using plastic cards in payments is reflected;

– 2700 rub. (RUB 17,700 x 18/118) – VAT is charged on the amount of cash proceeds;

DEBIT 90 subaccount “VAT” CREDIT 68

– 7200 rub. (RUB 47,200 x 18/118) – VAT is charged on the amount of revenue using plastic cards in payments;

DEBIT 50 CREDIT 90 subaccount “Revenue”

– 17,700 rub. (64,900 – 47,200) – revenue from the provision of services in cash was capitalized according to the cash receipt order;

DEBIT 57 subaccount “Sales by payment cards” CREDIT 62

– 47,200 rub. – the electronic journal was sent to the bank;

DEBIT 57 subaccount “Cash collection” CREDIT 50

– 17,700 rub. – funds were collected into the bank (a cash order was issued);

DEBIT 51 CREDIT 57 subaccount “Sales by payment cards”

– 46,256 rub. (RUB 47,200 – RUB 47,200 x 2%) – funds debited from clients’ accounts were credited to the current account (minus commissions);

DEBIT 91 subaccount “Other expenses” CREDIT 57 subaccount “Sales by payment cards”

– 944 rub. (RUB 47,200 x 2%) – expenses for paying commissions to the bank are recognized;

DEBIT 51 CREDIT 57 subaccount “Cash collection”

– 17,700 rub. – cash is credited to the current account.

Now let’s look at the acquiring operation from the tax accounting perspective.

Value added tax

Let us remind you that the sale of goods in Russia is subject to VAT. The tax base is determined on the date of transfer of ownership of the goods to the buyer as the cost of the goods (less VAT) (clause 2 of Article 153, clause 1 of Article 154, subclause 1 of clause 1 of Article 167 of the Tax Code of the Russian Federation). Taxation is carried out at a rate of 18 percent (clause 3 of Article 164 of the Tax Code of the Russian Federation).

The acquiring bank's remuneration is recognized by trading organizations as non-operating expenses (subclause 15, clause 1, article 265 of the Tax Code of the Russian Federation).

Paying by credit card actually means the buyer makes an advance payment. This must be taken into account when calculating the amount of VAT. The day of calculation of VAT for the seller will be the date of receipt of funds from the buyer, which is provided for in subparagraph 2 of paragraph 1 of Article 167 of the Tax Code. Since the moment of determining the tax base for VAT is the earliest of the following dates: the day of shipment (transfer) of goods (work, services), property rights or the day of payment, partial payment for upcoming deliveries of goods (performance of work, provision of services), transfer of property right

Income tax

On the date of transfer of ownership of the goods to the buyer, the proceeds received (minus VAT) are recognized as income from sales (clauses 1, 2 of Article 249, clause 1 of Article 248, clause 3 of Article 271 of the Tax Code of the Russian Federation). The specified income for profit tax purposes is reduced by the cost of purchasing the goods, which, in accordance with Article 320 of the Tax Code, refers to direct expenses (subclause 3, clause 1, article 268 of the Tax Code of the Russian Federation).

The amount of the retained agency fee (net of VAT) as of the date of approval of the agent’s report relates to other expenses associated with production and sales (subclause 3, clause 1, article 264, subclause 3, clause 7, article 272 of the Tax Code of the Russian Federation).

To check the correct reflection of the acquiring transaction, you need to check daily the posting of amounts from the Z-report to accounts 50 and 57 of the “Sales by payment cards” sub-account. Moreover, you need to compare not only receipts for the day, but also the cumulative total, highlighted in a separate line in the Z-report. This will allow you to track the completeness of the receipt of revenue.

In order to track the receipt of revenue to the bank and the correct posting of the bank commission, you need to compare daily the turnover on the credit of account 57 subaccount “Sales on payment cards” and the amount of turnover on the debit of accounts 91 subaccount “Other expenses” (bank commission) and 51 subaccount “Receipts” by payment cards." If everything is spaced correctly, then they should match.

And, of course, account 57 should not have a balance at the end of the day, provided that payment card transfers are received from the bank to the current account on the same day. If this condition is not met, then the total account balance should only include the debit turnover of the previous day (or the previous two days, this directly depends on how often the bank transfers money for acquiring transactions to the company’s current account).

You can also check yourself for the following common mistakes:

- An accountant can reflect in accounting the proceeds from the sale of goods not at the time of transfer of the goods to the buyer, but at the time of receipt of funds from the bank. This error leads to distortion of accounting and tax reporting when payment for goods by payment card and transfer of funds by the bank to the current account occur in different reporting (tax) periods;

- It is also possible to make a mistake if you reflect in accounting the proceeds from the sale of goods minus the commission retained by the bank under the acquiring agreement. This error leads to an understatement of not only sales revenue, but also expenses, resulting in distorted accounting and tax reporting. For an organization using the simplified tax system with the taxable object “income”, this error leads to an understatement of the taxable base for the single tax by the amount of the bank commission;

- other violations may be the sale of goods using payment cards without the use of cash registers, the lack of information about revenue received using bank cards in the cashier-operator’s journal, the cashier-operator’s certificate-report and information about the meter readings of cash registers.